You can find around three authorities-secured mortgage loans available today. These include named guaranteed once the bank that produced new funds try paid to have region or the loss if the loan ever go into property foreclosure. A vow could convince a lender to thing a loan approval getting an application that is considered marginal. For as long as the lending company approved the loan making use of the proper approval guidance this new ensure often incorporate on the longevity of the financing.

When you find yourself this type of promises are approved to the bank, it is the debtor one will pay the new premium for those formula. There was upfront premiums rolled toward loan amount and you can find annual premium paid-in monthly installments.

The fresh USDA financing is part of the higher United states Service out-of Farming. The new USDA loan has been in of several versions and you will try originally referred to as the new Producers Domestic Government mortgage. Very first prepared back into 1946, new mission installment loans in Bolton were to let individuals who populate outlying components having glamorous financing provides. Later on for the 1994, the brand new USDA try chartered to supervise the applying.

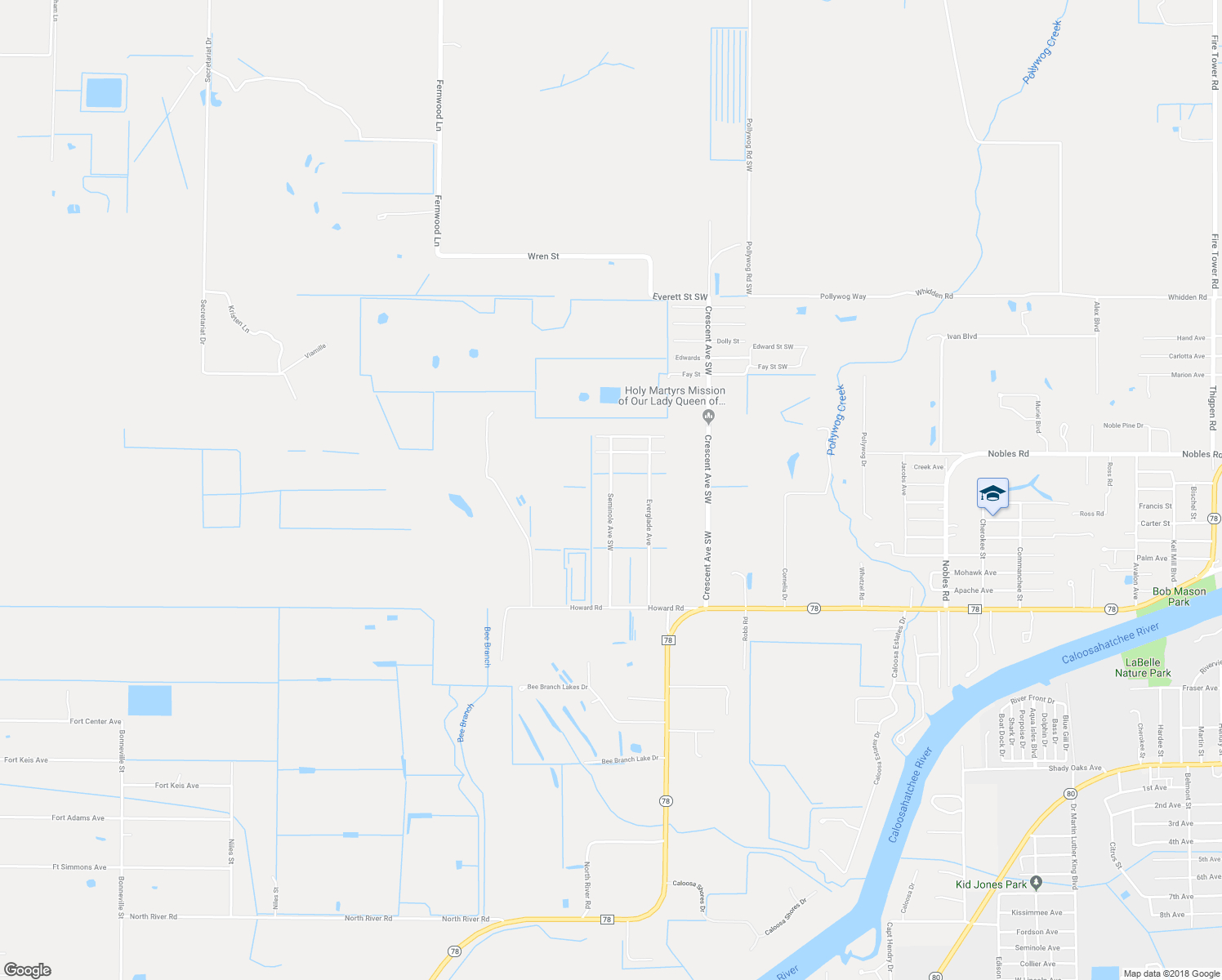

The latest USDA loan doesn’t need a down payment and will be offering individuals which have really competitive rates when you look at the a thirty-season repaired price title. USDA funds usually financing a house during the an outlying otherwise semi-outlying town where conventional money would-be tough. Extremely antique lenders today like to funds a property for the an area where you can find equivalent property in the neighborhood. Functions funded having good USDA loan need to be situated in a great pre-acknowledged, rural town.

The new USDA loan make sure implies that should the financing enter standard, the lender was compensated during the 100% of your harmony of your outstanding mortgage. Which loan make sure was a kind of mortgage insurance there are two such as for example designs. An initial advanced is rolled on loan amount and you may an enthusiastic annual premium is actually paid in monthly payments.

FHA loans including carry financing ensure. The FHA system is by far the most used loan alternatives having first-time people. There are, but one of them ‘s the low down commission FHA funds need. The fresh new downpayment specifications merely 3.5% of your own transformation rates. FHA financing can also be sometime more straightforward to be eligible for. Minimal credit history instance which have a deposit of step three.5% is actually 580, regardless if loan providers can be wanted their own lowest get and usually ranges from 600-620.

There are no restrictions as to what location of the assets, for example you can find having USDA money. For instance the USDA financing, there clearly was an upfront financial advanced rolling to the financing number and a yearly one paid back month-to-month.

FHA loans are not set aside having very first-big date people however they are often the first solutions

The very last government-guaranteed financing is but one using assistance established from the Service off Veteran’s Products. The Virtual assistant financing verify are twenty five% of one’s loan amount if the financing go into default. Of one’s around three bodies-secured loans, the new Va mortgage is the high starting loan, inspite of the insufficient a down-payment. The new 25% guarantee was borne regarding the means Virtual assistant financing limitations was basically computed. Whenever an experienced can be applied getting a good Virtual assistant mortgage, the lender then instructions and receives a certification of entitlement. Now, you to entitlement amount are $thirty six,000. The latest ensure are four times the level of entitlement brand new debtor has actually. Fourfold $thirty six,000 was $144,000.

The limitation Va financing calculation could have been a bit outdated and are after converted to mirror whatever the prevailing Compliant Financing Limitation was on the area. Now, the maximum Virtual assistant amount borrowed for many areas was $766,550, complimentary the newest compliant limit set by Fannie mae and you may Freddie Mac. That it restrict can change each year given that conforming constraints transform.

However, in the place of USDA and you can FHA finance, there was singular types of home loan insurance rates offering the be sure for the lender and not one or two. With Va finance, new make certain are funded by the Financial support Fee, which is an initial financial cost which is folded into the the final loan amount. There is no a lot more month-to-month financial premium for Va funds.

Those who qualify for a beneficial Virtual assistant financing become effective duty personnel with at least 181 days of solution, pros of military, National Shield and you can Army Reserve users which have half dozen or maybe more years of service and you can unremarried, surviving spouses of those just who passed away when you are helping otherwise because the a beneficial outcome of a support-related injury.

They are USDA, FHA and you can Virtual assistant mortgage applications and each is made for a specific kind of borrower otherwise condition

Delight reach out to you seven days per week with issues from the submission the fresh new Small Demand Function in this article.