Over fifty percent of all the students took into particular sort of financial obligation so you can pay for their education mostly using figuratively speaking. The common a good balance due? Ranging from $20,000 and you may $24,999. If you find yourself one of those having student loan obligations, what are the choices for finding home financing?

How can Lenders Look at Debt?Whenever providing borrowing, lenders greatest issue is if a debtor should be able to pay the loan back. They normally use a lot of data to find it out. One of the major of them will be to separate the fresh borrowers’ month-to-month expense by its monthly gross income. This is certainly called a great borrower’s obligations-to-money ratio.

Just remember that , loan providers can look at what you spend monthly, maybe not extent you borrowed from. When you yourself have $20,000 for the student loan obligations and come up with $200 monthly premiums, your own bank uses the fresh $200 monthly installments regarding the computation. Now, divide the quantity you pay monthly by your disgusting month-to-month earnings (just before taxation and other write-offs). It’s your loans-to-earnings proportion.

Discover an idea of your debt-to-income proportion, take into account the number you pay every month to suit your lowest credit credit payments, car finance, rent, mortgage, education loan, and other monthly installments

Should you decide Reduce Your own Figuratively speaking Prior to getting property?Considering waiting to get property up to your own education loan costs is reduced payday loan Southwest Ranches can seem to be like placing lifetime towards the keep. Whether you need to pay or off your beginner obligations really hinges on your specific finances. The cost of property control far is higher than precisely the monthly mortgage costs. There is insurance coverage, assets taxation, resources, repair, and lots of quick costs. On the other hand, and also make a wise capital within the a home you are going to give you economic balance in the proper housing market.

Talk openly together with your home loan administrator to decide whether or not now ‘s the correct time on how best to buy a house. They will be capable of giving your qualified advice about your genuine property sector, rates of interest, and economic standards to own funds you may want to be eligible for.

Of several financing choices are accessible to anybody long lasting types of from debt he has got. Certain preferred among younger borrowers which have student loans are conventional, USDA, Virtual assistant, and FHA money.

Old-fashioned loansIf you may have pretty good borrowing from the bank and will build a down payment with a minimum of step 3.5%, a conventional loan offers many great benefits together with PMI charge you to definitely end when you started to twenty-two% equity in your home.

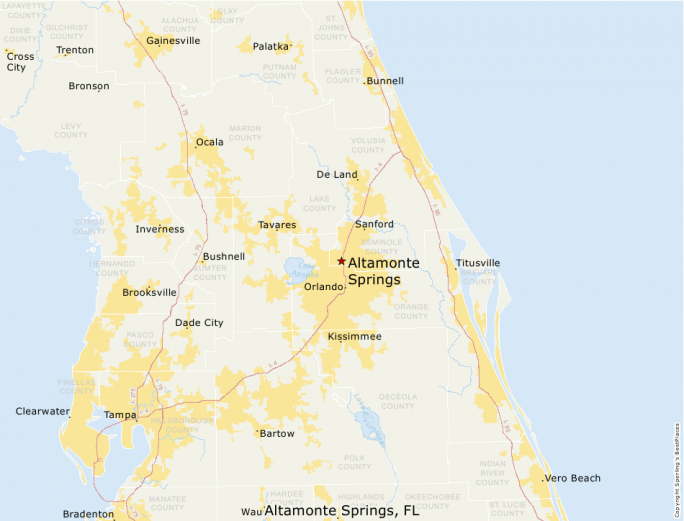

USDA loansIf you are looking to get a primary household during the an urban area recognized as rural of the USDA, a beneficial USDA financing is a wonderful solutions. Chief one of many positives for these which have student loan obligations is a great 0% minimum deposit no individual financial insurance costs.

Virtual assistant loansAnother higher 0% downpayment selection for individuals who are former otherwise newest professionals of your U.S. army. Virtual assistant loans are available to loans the acquisition from no. 1 residences simply.

They might be open to consumers that have FICO fico scores only five-hundred

FHA loansIf your own credit might have been diminished of the student loan money, imagine a keen FHA loan. You are going to need to make a deposit out-of step 3.5 so you’re able to 10% based on your credit score, but it are a good idea to begin with building economic balance having a home.

If you Buy A property Today?Based on debt wants, taking advantage of the low rates of interest would-be a good alternatives. Get hold of your local financing administrator in order to decide throughout the regardless if you are in a position to own owning a home or if perhaps it can be more great for hold off.