Renovations feels overwhelming to start with, however the hard work can prove useful in tomorrow. That americash loans Opa Locka is why it’s so important to get the best do-it-yourself funds.

Plus handling basic things, fixing and you will boosting your domestic has got the likelihood of boosting its market value when you decide to sell they. Improving your family brings a way to address fundamental need when you’re incorporating upcoming really worth.

Home improvement finance can be unsecured personal loans one will vary in the each other costs and you will words, according to activities like your credit history. Before you take out that loan, research the options available and also have several rates regarding the performs expected to performed on your own family. A very carefully chose home improvement mortgage helps you get to the house you have always wanted.

- Most useful Complete: SoFi

- Ideal for Sophisticated Borrowing from the bank: LightStream

- Ideal for Reasonable Borrowing from the bank: Change

- Good for Less than perfect credit: Upstart

- Best for Versatile Words: Marcus

- Good for Big Domestic Fixes: Pick

- Perfect for Comparing Loan providers: LendingClub

- 7 Finest Unsecured loans getting Do it yourself

- Do it yourself Personal loan Criteria and Standards

seven Most readily useful Signature loans having Do-it-yourself

Loans for do-it-yourself create future renovations and you will fixes a real possibility. Before you take out a loan, get several prices to the cost of the designed home improvement.

Be the cause of injuries and unforeseen incidents whenever asking for the loan amount. If you were to think the sum is just too large, imagine waiting and you can rescuing more cash. Yet not, when the specific home improvements is frantically requisite, believe cracking house fixes with the tactics classified from the necessity. Speak with a financial adviser and you will research the loans available to pick what type would be best for your requirements.

Repaired rates of seven.99% Apr to % Apr Annual percentage rate mirror the new 0.25% autopay dismiss and you may good 0.25% head put disregard. SoFi rate selections are current as of 8/ and are subject to change with no warning. Not totally all cost and you will numbers for sale in all states. Pick Consumer loan qualifications facts. Not absolutely all candidates qualify for a minimal rate. Lower rates arranged for creditworthy consumers. The genuine rate is when you look at the selection of costs indexed above and will believe multiple factors, also comparison of one’s credit history, earnings, or any other affairs. Find ples and you can conditions. The newest SoFi 0.25% AutoPay interest rate cures needs you to definitely agree to build monthly prominent and you can desire payments from the an automated monthly deduction of good discounts or checking account. The main benefit tend to stop and start to become missing to possess periods in which you do not shell out because of the automated deduction away from an economy otherwise savings account.

SoFi started in 2011 and from now on keeps more 3 mil members. The company in the first place focussed into student education loans features since branched off to deal with other places out of money instance banking and purchasing.

What makes brand new offering unique is the fact SoFi provides a certain do-it-yourself financing that’s an enthusiastic unsecured unsecured loan. Unsecured loans none of them security and so are regarded as much safer into the debtor. Additionally, the mortgage has the possibility brief approval, that will need less than 1 day. You’ll build repaired payments more than a-flat title in order for there aren’t any errors otherwise a lot of falling prevents along the way to help you installment.

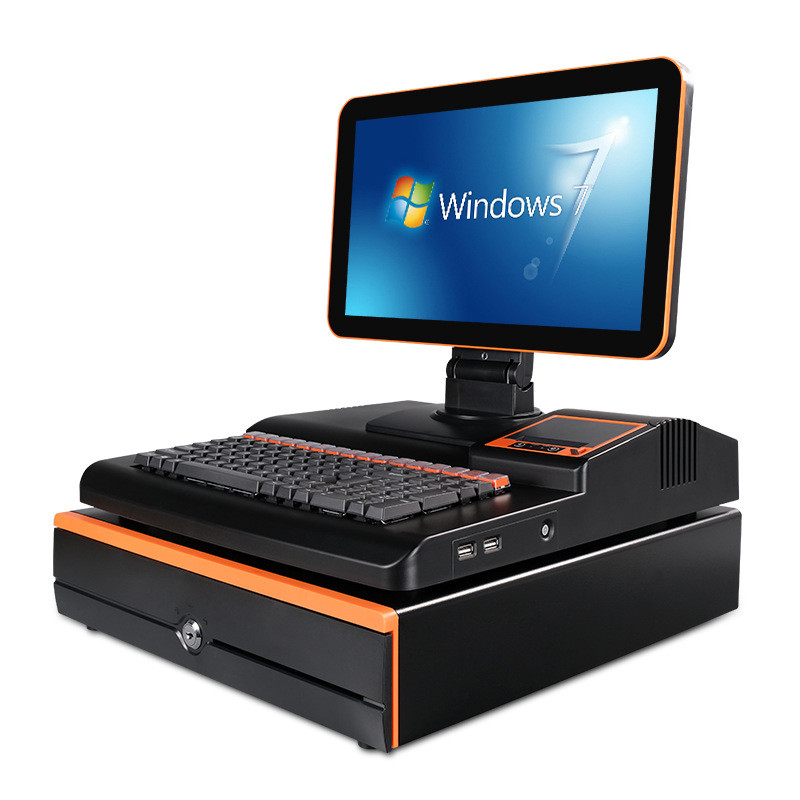

Ideal Home improvement Funds

SoFi claims there’s no lowest credit history wanted to found an unsecured loan however, encourages consumers to the office to your achieving high credit ratings before you apply. SoFi examines someone’s creditworthiness to determine whether or not they is actually a beneficial feasible applicant to own a consumer loan.

Complete, SoFi generally needs highest fico scores private money though a precise count to have property update mortgage isnt demonstrably said.