In the event your team features highest list membership or is positioned getting fast growth, but does not have cash flow, a secured asset-mainly based loan (ABL) may be the finest match. See if a secured asset-built financing can perhaps work for your business.

Do your organization possess profile receivable and you can index and this can be leveraged to change exchangeability? The sort and you will quality of the working-capital produces all the the difference.

Companies that care for high levels of top quality working-capital property and you may make smaller income was best people to have an asset-centered mortgage (ABL).

Find out if a keen ABL is right for you

Current house equity is key for leveraging a secured item-depending mortgage. Producers, vendors and you will shops are fantastic candidates getting ABLs as they purchase somewhat inside the working-capital and you can, in some instances, produce seemingly lowest free cash flow (FCF).

An ABL will likely be perfect for a family with the reputation, especially if he could be poised for rapid gains, purchases or considering a stockholder buyout, claims Dave Slavik, older vice president getting You.S. Bank Resource Depending Funds.

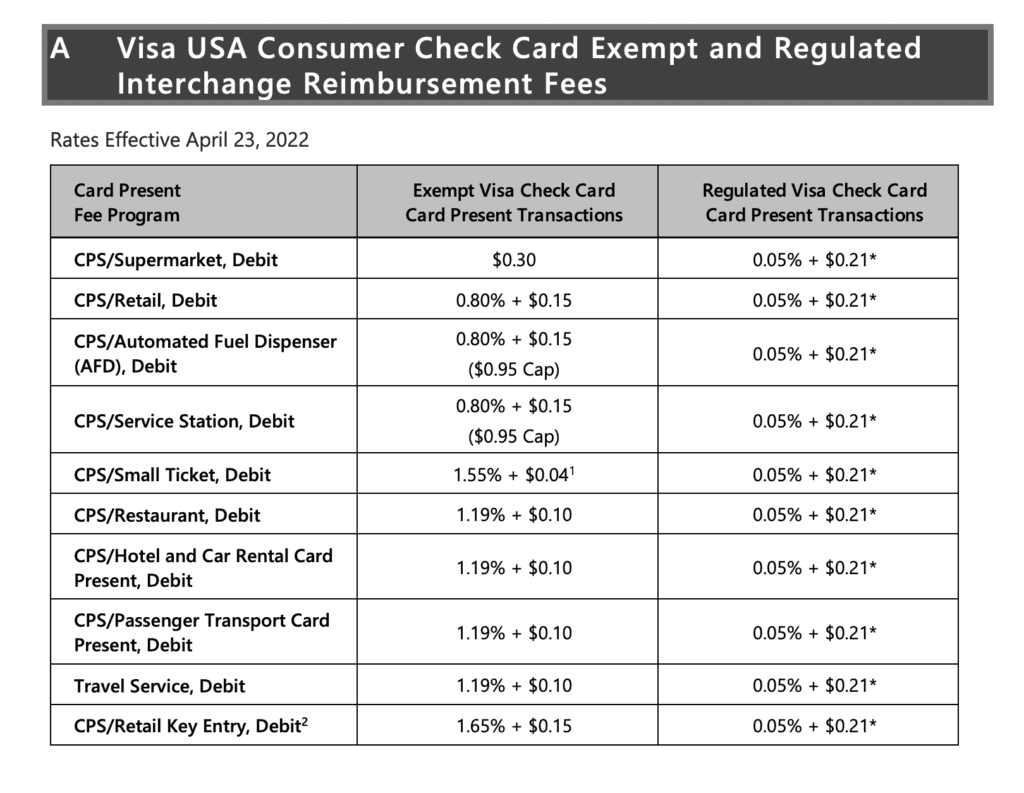

The conventional means to fix level elder loans strength are a function of money move, usually computed just like the a 3 or 4 time several regarding EBITDA (money in advance of interest, fees, decline and amortization). ABL spends a credit base considering working capital liquidation beliefs, and this normally start around 50-75% getting index and 85-90% to have account.

Eligible security has a hierarchy

Lenders devoted to advantage-dependent loans select collateral that is liquids, Slavik adds. The fresh new pile-score advantage preference is usually below:

- Receivables

- List

- Devices

- A house

The higher an asset is within the ranking, the greater number of water it is, Slavik explains. Ideal equity is actually profile receivable or index that is with ease cherished and you will monetized. These are generally products such material, lumber, eating, electricity otherwise petroleum. Fundamentally, the faster the fresh asset’s turnover, the greater attractive it is given that equity.

Conversely, ineligible assets are often people who have down really worth otherwise those who can be at the mercy of thing changes from inside the consumer trends. Particularly, good wholesaler regarding shingles is recognized as stable because dimensions, search, construction and you may amount of directory isn’t planning to feel material 12 months-to-seasons transform. It balances is not necessarily the exact same to own good wholesaler out-of clothes or technology-depending points. Both instances is susceptible to possible obsolescence due to changes in demand trend and you may tool mix.

Certain security designs become more difficult than the others

- Receivables which might be past due otherwise at the mercy of high dilution account

- Foreign receivables in place of insurance

- List that is mainly sluggish-swinging, formal otherwise consigned

- Solitary mission a home otherwise gadgets that may be hard to monetize

Highest institution, such a steel factory otherwise foundry reference, is actually tricky due to the fact security, but multipurpose structures like warehouses close thicker town centers aren’t.

Inventory subject to trademarks can also be difficult, Slavik adds, due mainly to the potential for this new trademark manager so you’re able to restrict liquidation avenues in an effort to manage their brand. Together with, directory considered to be operate in procedure is typically not qualified getting borrowing or are certain to get a diminished progress rates.

Its sensible to prepare having an interviewing prospective loan providers

Lenders usually start the whole process of evaluating a debtor because of the dispatching career examiners to review the working-capital property. In the event the applicable, alternative party appraisers also are interested to test catalog, equipments and you may gizmos, and you can home. After resource, the lender tunes alterations when you look at the worthy of by way of periodic career assessments and you can catalog appraisals. As the a debtor, you are requested add account at the very least month-to-month, that echo changes in the quantity and/otherwise value of their pledged possessions.

- Carry out they require a relationship – otherwise manage it find it once the merely an exchange? It’s always best to work on a loan provider that wishes a good relationship with your company and tries to build believe.

ABL price is competitive with old-fashioned fund

Will cost you can vary by bank, but the majority borrowers can expect to pay mortgage will set you back such an ending commission, a primary attract charges, bare charge and you will more compact keeping track of fees. Despite alot more aggressive control threshold and higher advance prices, ABL pricing is just like traditional dollars-move formations because of the ABL equipment that have typically reduced losses community wide.