The current home collateral mortgage rate into the Virginia for ten-year funds averages seven.7%, matching the fresh new federal rates. Getting 15-seasons financing, Virginia’s average was 8%, a bit greater than the federal speed out of eight.9%.

By Zachary Romeo, CBCA Reviewed of the Ramsey Coulter Edited because of the Denise Cristobal By Zachary Romeo, CBCA Analyzed by Ramsey Coulter Edited from the Denise Cristobal About Page:

- Current Virtual assistant HEL Pricing

- Virtual assistant HEL Pricing because of the LTV Ratio

- Va HEL Costs because of the Urban area

- Virtual assistant HEL Loan providers

- Getting a knowledgeable HEL Rates

- FAQ

Brand new security of your house that you could availability and use is named tappable security. A property collateral financing (HEL) makes it possible to maximize your house guarantee, whether you’re seeking to financing do it yourself plans otherwise consolidate financial obligation.

Virginia’s home equity financing cost was 7.7% Annual percentage rate for an excellent ten-year term and you can 8% for a 15-year name, versus federal averages from seven.7% and you can seven.9%, correspondingly. We now have gathered in depth understanding with the most recent household collateral financing rates within the Virginia, as well as urban area-certain prices, better loan providers and you may some tips on protecting the best cost for making use of their home’s collateral.

Trick Takeaways

High loan-to-value (LTV) percentages produce large pricing. The common Annual percentage rate for a good fifteen-seasons HEL within the Virginia that have a keen 80% LTV try seven.8%, than the 8.5% for an excellent ninety% LTV.

HEL pricing will vary from the area from inside the Virginia. Such, to own fifteen-12 months finance, Cumberland features the typical Apr of five.9%, whereas Onley’s try 9.8%.

Some other loan providers give varying prices for the very same financing sizes. Merck Team Federal Borrowing Union’s mediocre Annual percentage rate is 5%, while Spectra Government Credit Union’s is a dozen.5%.

MoneyGeek checked-out 62 additional finance companies and you may borrowing unions during the Virginia using S&P Global’s SNL Depository Pricing dataset to remain most recent on the current domestic equity financing pricing.

Most recent Family Guarantee Financing Cost during the Virginia

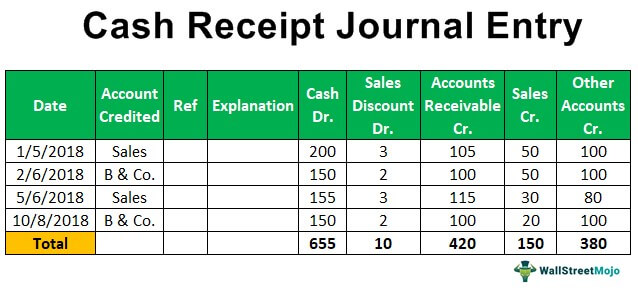

The current average Apr for an excellent 15-year home equity mortgage in the Virginia try 8%, regardless if multiple products you’ll apply to exactly what lenders promote. A top credit history could secure you a far more advantageous ount you’ll increase your rates. Repayment words plus play a role in deciding their rate. Mention the brand new desk evaluate an average APRs away from domestic equity financing during the Virginia all over additional loan words.

Interest rates to own a property equity mortgage change each and every day. Keeping track of such transform will save you money on appeal over the longevity of the loan.

Such as, a beneficial fifteen-year family security mortgage having an enthusiastic 8% Apr contributes to a payment per month out of $478 and a whole notice away from $thirty six,009. Having said that, good 10-season mortgage having a good eight.7% Annual percentage rate has a monthly payment out of $599 and an entire interest off $21,849.

Home equity money and you can domestic guarantee personal lines of credit (HELOC) are common alternatives for home owners so you can utilize its residence’s equity. Home guarantee loans has fixed cost, averaging seven.7%, whenever you are HELOC pricing inside Virginia is actually varying, averaging 8.2%.

Fixed cost mean your instalments are ongoing, getting predictability having budgeting. Changeable prices, such as those regarding HELOCs, is 1st feel straight down but may boost, ultimately causing high payments over time. Information these distinctions makes it possible to manage your finances effortlessly.

Household Guarantee Loan Costs of the LTV Proportion

The pace your qualify for relies on the loan-to-worth proportion, and that tips exactly how much your debt on your own mortgage compared to your home’s appraised worth. To help you estimate their LTV proportion, separate your existing financial balance by your residence’s appraised value and you will proliferate of the 100. Like, should your house is appreciated on $300,000 while owe $240,000 on your cash advance loans Orchard CO mortgage, the LTV proportion are 80%.

A top LTV proportion setting even more exposure to have lenders, resulting in high prices. In the Virginia, the common Apr to possess an excellent 15-12 months security financing that have an 80% LTV proportion is actually eight.8%, as compared to 8.5% for an excellent 90% LTV ratio. Browse the desk lower than to see what prices you might be considered to possess centered on your LTV proportion and you can mediocre family security mortgage cost.