Straight down mortgage prices and higher solution.

Larisa intentions to pick a flat in Ukrainian Village. Seven days later she generated an offer, the vendor acknowledged they, and so they provided to close-in a month. Larisa doesn’t have long to discover the financing she must find the condominium, very she dropped by the financial institution in order to theoretically make an application for brand new home loan.

Immediately following she finished their unique application for the loan, the borrowed funds administrator provided Larisa the original disclosures, together with financing Imagine. Then your financing officer asked for good $450 evaluate to cover price of the property assessment statement the financial institution commonly acquisition in advance of it approve Larisa towards mortgage.

Look at it since your commitment to a loan provider. It indicates you removed that loan, possibly which includes financial. You opposed Loan Rates and you may select that family mortgage plus one bank.

Dont shell out any financing costs before you choose a loan and you may a loan provider. It is unlawful to have a lender to gather a charge unless you look for the Loan Guess and you can notify them that you’re moving to come using their financing bring.

Jim Quist

Its for you to decide to choose and this bank you plan to use to possess their mortgage. You don’t need to do anything if you opt to go elsewhere. The lending company have a tendency to cancel the job automatically within this 30-weeks while you are silent.

Shortly after looking at the Financing Estimate, Larisa think the newest bank’s rate of interest and you can costs was in fact a little large. She don’t signal the original disclosures otherwise create a check. Rather, Larisa told the loan manager you to definitely she’s going to shop and you can compare the fresh new bank’s give with a special bank.

Notify the financial institution of your own intent so you can go-ahead contained in this personal loans for bad credit Colorado 10 team weeks after you incorporate. Capable replace the terminology, for instance the costs if you take more.

After you invest in the lender, they’ll start working on your own loan. Expect you’ll give files to ensure your a position, income, and you will savings account balance. Additionally, you will pay some of the fees listed on the Mortgage Imagine. As you informed the financial institution which you can get its financing provide, you are on the latest hook up for non-refundable third-party fees such as the assessment report.

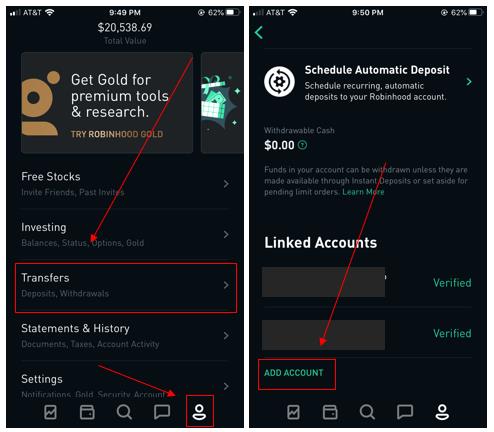

After you to date Larisa discovered a far greater price from the newcastle.fund where she used online and got approved in approximately 15 times. She examined and you can elizabeth-closed the first disclosures (and additionally a copy of the Purpose in order to Go-ahead Having Application form), bought the fresh new assessment statement, and you can published some documents to the borrowed funds Dashboard – all the online inside one hour.

Get it done nevertheless wanted, provided the lender is also list they. Rules want loan providers to truly get your intention in order to go ahead ahead of event charges away from you, nonetheless they never specify exactly how. Specific lenders need your spoken acknowledgment. Really have a tendency to request you to sign this new Intent so you’re able to Go-ahead With Application.

I accept both your spoken or composed notice. The loan manager will listing your own verbal intent to go ahead. When you do your house financing on the web on newcastle.financing, you can utilize the borrowed funds Dash so you’re able to simply click-to-sign the fresh new Intent in order to Proceed means.

Everything is towards the-track having Larisa. It’s their particular first-time to acquire a home and you can this woman is happier. Unfortunately, not all homebuyer provides an excellent feel. Whether your number into loan data is actually blurred, or perhaps the idea of taking out a massive financial try distressful, next chat to the loan manager – and you can get it done quickly. Think about, you are significantly less than contract purchasing a house thus make your best effort to get to know the newest due dates.

This may help be aware that the fresh Intention in order to Just do it isn’t really a joining file. You could potentially key lenders anytime. Indeed, nothing of the financing disclosures and/or home loan files your indication was binding if you do not get to the closure.

When you are not knowing concerning the mortgage administrator or the bank, ask your realtor so you’re able to recommend some body he or she trusts. Look at the lender’s experience, customer service, and you will reputation. Choose social evidence, beginning with Google and you may Facebook product reviews.

- Let us cam – Plan an excellent fifteen-minute call on my schedule.

- Learn how to get a reputable financial speed offer in step 1-second.

- Jim Quist, president (lic#150600), NewCastle Home loans (lic. info)

- Performed We skip one thing? Exit your feedback lower than.