FSA’s Guaranteed Farm Mortgage Applications assist family members growers and you may ranchers so you’re able to obtain finance out-of USDA-acknowledged commercial loan providers on realistic conditions to acquire farmland otherwise fund agricultural manufacturing. FSA will guarantee ranch financing thanks to a commercial lender around $2,236,000. Financial institutions discovered additional loan team and benefit from the protection web brand new FSA brings from the guaranteeing ranch money upwards so you can 95 per cent up against it is possible to economic death of principal and you will attention.

Info

- National Farming Library Ranch Business Evaluation

- U.S. Small business Management Performing and you may Dealing with Your business

Protected Ranch Financing Frequently asked questions

Guaranteed funds will be property and you may obligations of financial. The financial institution and you can loan applicant finish the Software getting Verify and you may complete they with the FSA Services Cardiovascular system inside their lending town. This service membership Center deals with the economic financial to process brand new ensure. The fresh Farm Financing Manager reviews the application for applicant qualification, payment function, adequacy out of collateral, and you will conformity with other legislation, incase the latest applicant matches men and women requirements, the fresh request is approved. The service Heart situations the financial institution an effective conditional commitment explaining the brand new terms of the loan ensure and you can showing that mortgage will get be closed. The financial institution closes the borrowed funds and improves finance to your candidate, and this service membership Cardiovascular system personnel points the fresh be sure. The financial institution helps to make the loan and you will attributes it to end. Whether your bank suffers a loss of profits, FSA usually refund the financial institution according to the small print given on the make certain.

A primary mortgage try financed really from the Agencies. The money employed for head loans is inspired by yearly Congressional appropriations acquired included in the USDA budget. The brand new Agencies accounts for making and you will repair the mortgage.

Farm Possession fund can help pick farmland, create or fix houses or other accessories, develop farmland to market crushed and you can liquids preservation, or even re-finance loans.

Ranch Working financing ent, supply, seed products, stamina, ranch toxins, insurance coverage, or any other performing expenditures. Operating funds plus enables you to purchase slight developments in order to buildings, costs associated with home and you may water innovation, household members bills, and to re-finance personal debt around particular standards. These loans can be organized because the name financing otherwise contours away from credit dependant on the point and suggested identity of the mortgage.

The newest EZ Ensure Program is available having faster finance. This program provides a basic Guaranteed Loan application process to help quick, new or underserved household members farmers which have early financial help. The newest EZ Be sure can be acquired getting loan applications as much as $100,000 getting farm performing or farm control objectives. Sleek monetary underwriting can be found for these financing, enabling all approved lenders to analyze the brand new request in the same method in which they would get acquainted with a nonguaranteed financing demand out of an equivalent size and kind. The current qualifications, mortgage goal, cover, and other standards continue to be an equivalent.

As well as the most frequent variety of funds in depth a lot more than, FSA has the benefit of secured Preservation Funds and you will Belongings Bargain Claims.

- feel a citizen of the United states (or legal citizen alien), which has Puerto Rico, the newest U.S. Virgin Countries, Guam, American Samoa, and you will certain former Pacific Faith Territories

- have a fair credit history since the influenced by the lending company

- have the courtroom capability to happen obligations toward mortgage obligation

- not be able to get a loan in place of a keen FSA make certain

- not have triggered FSA an economic losings of the finding debt forgiveness for the more step 3 times toward otherwise just before April 4, 1996, or any occasion just after April 4, 1996, into often a keen FSA direct or make certain loan

- end up being the manager-agent or renter-agent out of children farm adopting the mortgage are signed. Getting a functional mortgage, the producer should be the driver out of a family ranch once the mortgage try finalized. To own a farm Control mortgage, the company might also want to very own new ranch

- not be outstanding with the people Government loans.

Maintenance Financing applicants do not have to meet up with the “family members ranch” meaning nor manage they must be struggling to get a great mortgage rather than an enthusiastic FSA make certain. Other qualifications requirements need to be met.

All the ranch process try examined to your a situation-by-circumstances basis. Discover step three first concerns you could potentially wonder during the choosing in the event your farm company was a household farm:

FSA can be be certain that practical Working fund, Ranch Control loans, and you can Conservation money up to $2,236,000; it number are modified per year per Financial Seasons based on rising cost of living.

The brand new Guaranteed mortgage rate of interest and you can commission terms and conditions was negotiated between the lending company as well as the applicant and could not go beyond maximum cost mainly based by the FSA.

Repayment terminology are very different with regards to the kind of loan generated, brand new guarantee protecting the borrowed funds, additionally the producer’s capability to repay. Performing Money are typically paid off contained in this eight many years and you may Ranch Possession finance do not surpass 40 years. Operating Lines of credit are state-of-the-art for as much as loans Scammon Bay AK four years and all sorts of improves should be paid down inside 7 several years of the brand new date of one’s financing guarantee.

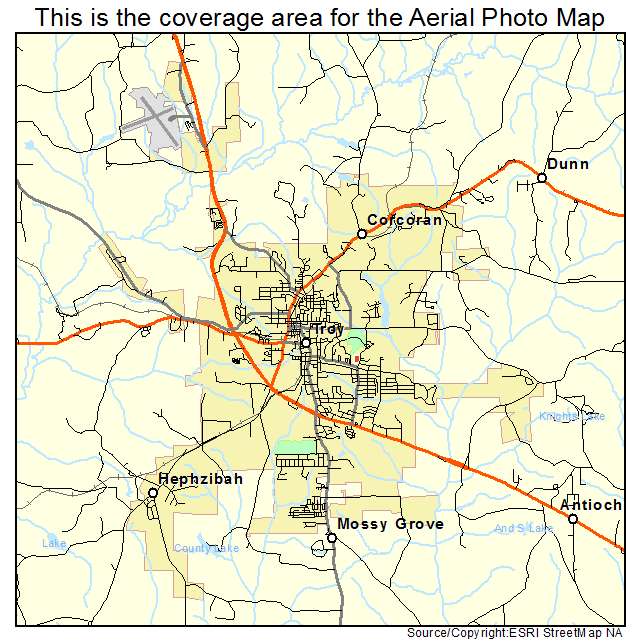

You can even just click one of several hook below and select the required county for a summary of latest FSA guaranteed lenders.

Take note that listing is meant to get you started by providing standard lender contact info. It might not include every agricultural lenders in your area, and many lenders features multiple twigs that aren’t specifically noted. Your local FSA Ranch Financing Cluster makes it possible to apply to a district financial, as well, or present a listing of loan providers recognized to make farming financing on the geographic place.

FSA reviews the mortgage software to choose in case your financing applicant is eligible for the asked loan. This new applicant’s financial will receive created notice of each step-in the process, like in the event that software program is received, whenever more info is necessary, when a qualifications determination is established, if in case a last decision is established. In case the software is recognized, FSA notifies the lending company, the lender shuts the loan, and financing fund is actually distributed as required. In case your software is not approved, the financial while the mortgage applicant is actually informed written down of the particular aspects of perhaps not giving the mortgage, and you may financing individuals are provided reconsideration and desire rights.