From inside the a recently available article, i discussed the latest particulars of home loan issues (or disregard activities) and you may in the event it is practical to spend them to reduce steadily the rate of interest on your own mortgage.

Because the interest rates still rise, these types of buydowns get more of a subject regarding talk certainly homebuyers and you can sellers, in addition to their representatives and you can loan providers.

Of these buyers who have been to the cusp from being qualified getting home financing in the first place, rising costs you will spell disaster and get away from them off acquiring the amount of capital must get property.

This will along with become a challenge getting sellers. Considering a recent post of the Home loan Information Day-after-day, mortgage apps only hit their reasonable membership for the twenty two ages.

Although we are still technically into the a seller’s field (way more demand for residential property than likewise have), this new tides are altering. A lot fewer customers capable qualify for financial financing means less buyers putting in a bid towards property. If you are in a hurry to offer, this may suggest being required to reduce the cost of the home to draw qualified people.

None buyers nor suppliers winnings whenever interest rates rise such the audience is viewing now. not, there is certainly a means for the home loan and you may a home party to function to one another in order to make a victory/Victory circumstance for everybody involved the vendor-Paid Speed Buydown.

What is A provider-Paid down Rates Buydown?

Lenders allow supplier out-of property to help you credit a portion of the proceeds toward family visitors. This is entitled a vendor concession. Merchant concessions can be used to spend a consumer’s closing costs merely, and cannot be employed to help with the latest advance payment.

Exactly what educated home loan and real estate agents discover is the fact supplier concessions can also be used to pay financial affairs and buy on the rate of interest.

The whole suggestion towards provider-paid off rates buydown is to obtain money back on the vendor in order to permanently get down the interest. The majority of agencies and you will home loan pros have a tendency to dispersed the vendor money in order to underwriting will set you back, escrow costs, and you may mortgage charge…very few of them think to forever get on the focus rate towards loan and therefore reduces the fresh new month-to-month mortgage repayment.

Which Advantages of A merchant-Paid off Price Buydown?

Inside a consistent seller’s sector, in which you’ll find always multiple has the benefit of to your property and you can biddings wars are the norm, this may be genuine. But once we in the list above, ascending interest levels try throttling value and you will causing fewer financial applications especially for high-charged land.

When this is the situation, the fresh new go-to help you solution is to your seller to reduce the latest price tag of the house. However, this is really not the way to go. A provider-paid down rate buydown will in truth end up in far more earnings for the customer And supplier.

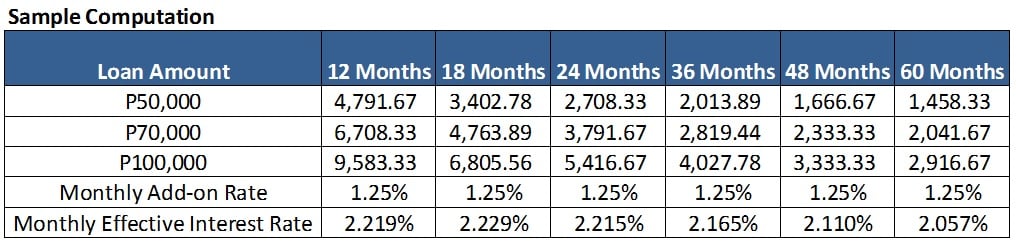

Less than are an example http://www.paydayloansconnecticut.com/shelton from financing evaluation demonstrating choices for purchasing a great $five hundred,000 home playing with a thirty-season fixed-price mortgage from the an effective 5.5% interest.

Because of it example, let’s say the consumer is only able to be eligible for a payment per month off $step 3,000. As you care able to see in the 1st line exhibiting the market industry speed and you may speed, the buyer wouldn’t be capable afford the home in it circumstance.

Price Avoidance Approach

It alter do end in some offers to the customer, but the required payment do be excessive. This strategy would also reduce the seller’s web profit by $20,000 a large amount.

Seller-Paid off Rate Buydown Method

Today evaluate what would occurs if the supplier paid down dos things to purchase on the rate of interest by .5%.

Just perform this 1 slow down the payment per month adequate to exactly what the buyer you’ll be eligible for, it might also increase the newest seller’s web gain $10,500 compared to rate prevention means.

When planning on taking they one step next, the very last column suggests exactly how much the seller carry out now have to attenuate the price of the home to reach the same payment per month because the rates buydown strategy $27,270, that’s almost 3 x the cost!

Last but most certainly not least, through the elimination of the rate, the buyer commonly discover way more deals over the lifetime of their loan not just initial.

The bottom line

Dealings on the speed and you can merchant concessions are part of most of the real property exchange. Exactly what of numerous don’t understand is that a seller-repaid speed buydown means now offers much more pros for everyone functions involved fundamentally:

- Giving an around-sector interest towards the property commonly draw in much more customers

- Preserves the seller money upfront

- Preserves the consumer cash in tomorrow that have lower repayments and a diminished interest rate

- Helps hold home prices into urban area

- Stops the brand new stigma away from a discount

If you would like for additional info on the advantages of a provider-repaid rates buydown strategy, or you desires get a hold of a loan comparison equivalent towards the one more than to suit your sorts of purchase circumstances, complete the form lower than so you can demand home financing breakthrough appointment having our experienced mortgage advisers.