Each other household equity money and home security credit lines can also be be employed to consolidate present personal debt, have a tendency to saving you money. It is that it just the right option for you?

Of a lot otherwise the companies featured offer payment to LendEDU. This type of earnings try how exactly we manage all of our totally free solution to possess consumerspensation, plus days off in the-depth article search, identifies where & how companies appear on our very own website.

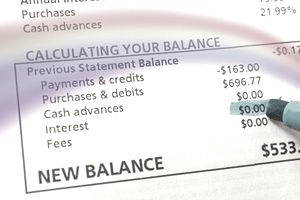

Of numerous domiciles carry significant amounts of financial obligation anywhere between the mortgages, signature loans, charge card stability, student education loans, and a lot more. Indeed, the common Western have $90,460 worth of financial obligation, top of several to wonder if they tap into their possessions that have a home equity loan getting debt consolidation.

If you have gathered collateral of your house, you can think opening these funds in order to consolidate the loans and start using it down reduced. This will not only clarify your instalments and also protected a potentially lower interest than just you may be expenses in other places, helping you save currency through the years.

But simply as the domestic collateral funds or personal lines of credit was nowadays doesn’t necessarily indicate he’s usually the right choices. Listed here is a look at exactly what domestic equity fund and you can HELOCs try, the best way to no credit check installment loans Memphis use them for debt consolidating, and how to decide if it’s the best move to you personally.

Why you should believe a house security loan otherwise distinctive line of borrowing from the bank to consolidate loans

The common citizen about You.S. has actually about $185,one hundred thousand home based collateral. Guarantee represents the difference between the house’s latest worthy of in addition to leftover equilibrium on the financial. You to security is recognized as a valuable asset, it is commonly unblemished before homeowner sells their residence.

As opposed to enabling your residence security stand untapped for many years, you can utilize that money to possess home improvements, to fund huge expenditures, or even to combine and you can pay-off other sorts of financial obligation. This will be extremely without difficulty completed with the assistance of a property security loan or home security credit line, labeled as a beneficial HELOC.

There are various benefits to utilizing your residence’s equity in order to consolidate obligations, which we’ll plunge to your in only a second. Such masters could easily were:

- Less interest levels

- A lot fewer financial obligation stability to help you juggle

- Total focus savings

- Down monthly obligations

Once the household equity financing and you may lines of credit is actually secure because of the the value of your home, rates of interest usually are lower than other kinds of personal debt eg credit cards or personal loans. When you’re covered obligations can often be easier to receive and a lot more sensible, there are several additional risks to take on.

Masters and you may downsides of using property equity loan so you’re able to combine loans

Just like any other monetary device, you can expect each other advantages and disadvantages so you’re able to taking out a home collateral loan otherwise HELOC to combine the debt. Here are a few of the biggest advantages to think and you may disadvantages to notice.

Pro: Smooth money

Present investigation signifies that the average American mature is the owner of regarding four charge card accountsbine by using other sorts of consumer debt-for example unsecured loans, auto loans, charge cards, personal lines of credit, and a lot more-and it’s really easy to understand just how obligations cost could possibly get complicated.

Instead of create four some other repayments monthly in order to five additional creditors on the five various other repayment dates, property security loan otherwise personal line of credit can merge her or him all the on you to definitely.

By using property guarantee financing otherwise HELOC, you can pay several balances and you can clear plenty of costs. You may then only need to care about paying their that domestic collateral loan to your its you to due date.