- Money Financing

- Build Possessions Collection

Strengthening a property collection was a lengthy-label financing approach that can yield ample returns whenever done right. Success hinges on with a definite investment strategy, dealing with gurus, and you may continually evaluating and you will changing your own portfolio because the business changes. Be patient, plan very carefully, and build a profile one to obtains your financial upcoming.

What is A home Profile?

A home collection are a couple of most of the properties a keen buyer owns having strengthening wide range. It will keep many different types off possessions in almost any cities.

- Increase your chances of good production by the investing in features when you look at the many metropolises and you will selling prices (diversification).

- Access a whole lot more guarantee, that will help grow your portfolio then.

- Reduce financial threats but if a home financing goes wrong, compliment of diversity.

- Increase success regarding rental give and you can value of.

- Perform a unique strategy for future assets using trial and error.

- Achieve your monetary requires less.

How to start Building Property Collection

The best technique for building a home collection is special to each individual trader. Here are some ideas to own college student people doing a portfolio.

step 1. Put Forget the Desires

Your investment specifications tend to determine the brand new models and you can type of investment which can be really winning for you. Setting an objective will help you to perform appropriate financing procedures and you will build decisions more quickly.

2. Plan Disregard the Method

You might spend money on different types of characteristics, such solitary-friends residential property, apartments, detached homes, and you can industrial internet sites. To increase their return on investment, you could apply confirmed actions such as for instance pick-and-keep, fix-and-flip, or leasing away, and is divided into two types:

- Local rental give actions, instance rentvesting, renting it, etc.

Given that home relates to huge sums of cash, due diligence needs for all property instructions, specifically very first. New security and you may profit from it first resource will determine how quickly and efficiently you can grow your profile.

Purchase a feasible count with the a property with a high development possible to start your investment excursion. As it’s the first purchase, consulting with educated industry experts may help improve your odds of victory. Lenders, real-auctions and you will buyers’ representatives may help identify an educated property purchases and loan alternatives for your.

cuatro. Grow your Portfolio Steadily

Once a successful very first pick, use the payouts and you may security of it which will make a beneficial varied profile. Purchasing is a lengthy-name efforts and needs determination, both when no credit check loans in Mcintosh AL you find yourself to order and selling.

Put possessions affordable shortly after checking which have a financial adviser. Be sure you do not overburden your self financially. Just before investing new characteristics, know about the brand new up coming trend in the market and exactly how it often change the prices of your assets.

5. Diversify Your Portfolio

Always put money into attributes across the some places and advantage kinds in order to diversify, and employ various other capital strategies in order to know and that choices are best for your financial needs.

If you were investing when you look at the town, pick services inside the rural otherwise local section. If you were to get attributes, you might browse the economical market and apply the latest methods appropriate to those services.

six. Tune The success of Your own Collection

A house financing profile works in the long run merely when it will continue to provide confident production over the years. Keep track of all of the sales and you can conversion, as well as the steps utilized for per property.

When the these wide variety is actually positive, remain growing and diversifying their portfolio having a similar approach up to you are able to the prevent requirements.

Rating Help from Pros On your own Very first Money spent

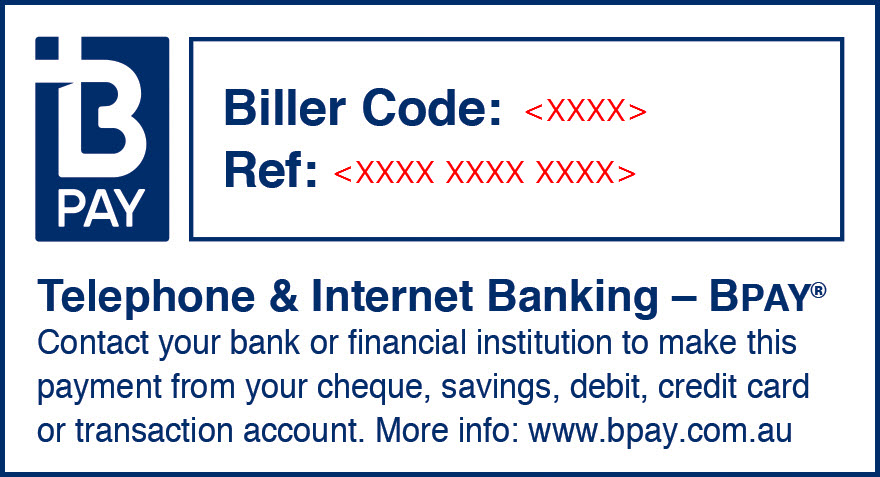

We can help you get your very first money spent and begin your profile travel of the complimentary you toward right loan providers to possess your position. Call us from the 1300 889 743 or fill in all of our 100 % free inquiry mode for more information.