Federal national mortgage association HomeReady Mortgage

New Federal national mortgage association, identified most readily useful as the Fannie mae, is a federal government-paid institution. Federal national mortgage association possess a good long-standing policy to have low-citizen U.S. consumers, getting DACA borrowers with similar options to own credit U.S. people would have.

- A personal Safety matter, Tax ID or an enthusiastic unexpired a position consent document (EAD) to ascertain evidence of court visibility throughout the U.S.

- Proof of proceeded income, such as W-2s, pay stubs and you may/otherwise bank comments

Other conventional finance

You might be expected to has a higher credit rating otherwise spend a more impressive deposit after you get a conventional financing. With regards to the sized the lender, there is certainly of many levels in the underwriting process, therefore it is difficult to understand if or not you are recognized for good financial.

While you are having trouble shopping for a lender happy to manage your, a mortgage broker familiar with DACA otherwise international people is generally a great investment. Lenders shop the loan software around to numerous lenders so you can see the finest candidate.

- New Palace Financing: A faithful party away from DACA pros assists buyers exactly who anticipate to order a property because a main residence. New Palace brings mortgages getting buyers situated in Illinois, Indiana, Michigan, Florida, and you may Tennessee.

- Believe Mortgage brokers: Undocumented citizens in the Tx can find investment if they have a beneficial credit history out-of 620 or more and you can lawfully eligible to really works on the U.S.

Expected data files getting a good DACA home loan

Whatever the lender you method, you’ll end up needed to give certain pointers and data files in order to qualify. Make sure that your loan application try truthfully filled out. One of the greatest dangers is actually distinguishing your own judge position. E Ricci, a lawyer concentrating on complex immigration have aided more or less 500 teenagers qualify for DACA and its pros. She states, DACA proprietors can be sure to not claim that he is Legitimate Long lasting Citizens (Environmentally friendly Cards holders) otherwise Us citizens towards any loan requests. That may end in financing assertion and even imprisonment otherwise deportation.

- A social Security or Taxation Identity amount

- Latest A job Authorization Document (EAD cards) given by You.S. Citizenship and Immigration Properties (USCIS) regarding the C33 category

- Previously-expired EAD cards(s)

- Proof Money files to show it’s possible to make your monthly mortgage payment.

Your house to acquire techniques

Except for home loan degree, the home-to acquire process is similar getting DREAMers because is to have a great You.S. citizen. The process does take time – persistence and you may company are key. Here is what we offer:

Ensure you get your finances in check

Lenders are considering your money closely. Actually, the method can often be downright intrusive. You may be expected questions relating to scratching on your credit file or perhaps to determine people irregular deposits you have made. Therefore, it is preferable to truly get your funds managed in progress – you could begin six months so you’re able to a year to come of your energy.

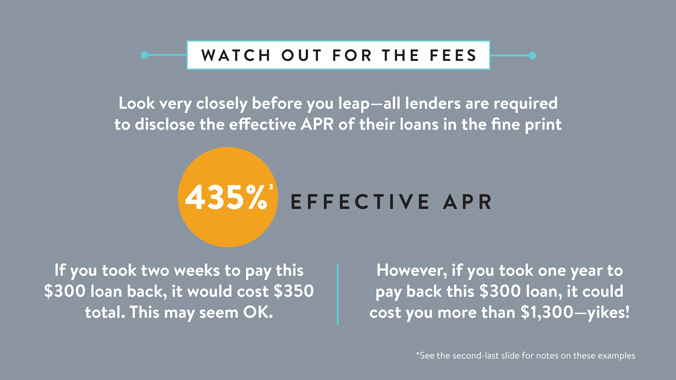

Certain an approach to ready yourself in advance is protecting to own an all the way down fee, in addition to getting money out to possess closing costs and you will charges. Focus on paying as frequently loans you could – your debt to help you earnings ratio is a primary reason for if their financial is approved. Repaying debts is served by an alternative work with – a lesser DTI ratio, as well as while payday loans Hazel Green making repayments constantly as well as on date improves your credit score.

See experts to aid

Dealing with experts who see your position and you can help your ideal of purchasing a property could help the procedure work with much easier. Require recommendations for realtors who has got experience with non-citizen consumers. Carry out a shortlist from loan providers or home loans whom specialize in DACA home loans. Strat to get moving prices to budget and cut toward pricing of disperse.