There are various means People in america can be dish right up debt. Many people need to use out student loans so you can visit university. Very autos are bought with a fund bundle . Credit cards is commonplace and several less financially savvy customers can tray up severe credit card debt without recognizing whatever they are doing. With all of this type of you can easily sources of financial obligation out, it’s possible to become drowning in financial trouble pretty quickly and it can become tough to learn how to price with it.

While a homeowner that numerous most other costs you would want to manage, there is certainly a choice on the market worth considering taking out fully property collateral loan and utilizing those funds so you can shell out the money you owe. It isn’t a decision is produced carefully and needs forethought and you will a powerful package. Whenever done correctly, whether or not, this tactic produces spending debts much easier and less expensive.

step three reasons to play with house equity to pay off most other costs

There are many reasons as to the reasons using property security mortgage so you’re able to pay almost every other costs was a good strategy for you. Here are a few to look at:

You can acquire a better interest

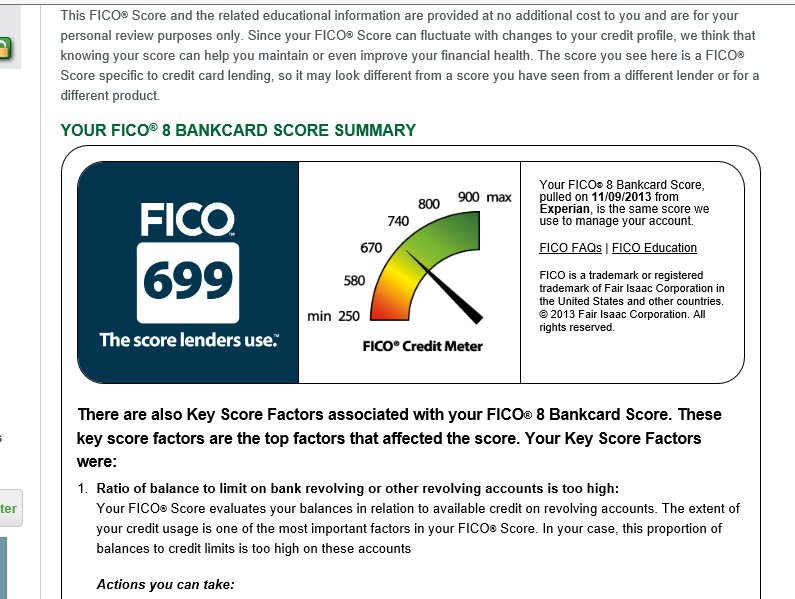

Interest is among the key numbers when contemplating financial obligation. The pace on your own mortgage identifies simply how much extra you owe to the lender and the dominating your debt from their website. Although your own very first mortgage is fairly quick, a leading interest may cause financial obligation locate out of you, putting you from inside the an opening you may have genuine dilemmas looking out out-of. When you yourself have plenty of highest-attract debt, you might be able to find a much lower price into the property guarantee loan.

Kim Hallway, an economic advisor from the Quality Wide range Advancement, performed note that home security loan interest rates also are quite highest at this time , a byproduct out of repeated step of the Federal Reserve . Nevertheless, in certain situations, having fun with a home security loan to settle most other funds you will add up. And considering the fact that bank card rates of interest are around 20% immediately – and you can domestic guarantee financing are significantly less than ten% having qualified individuals – it’s obvious the more sensible choice.

“I might say that if you have large interest personal debt particularly credit debt, that would probably be an option,” she says.

You might improve your payments

What if you have $10,000 inside the credit card debt, $5,000 when you look at the education loan personal debt and you can $eight,000 in car loan obligations. That’s three additional payments you have to make every month. Whenever you are autopay have helps make it convenient, will still be three other loan providers you have got to manage in the event that you will find problematic and you will three different totals you have got to tune to determine when you find yourself done paying a financial obligation.

If you took away a $twenty-two,000 domestic equity loan, though, and paid off all these existing expense with that currency, would certainly be kept that have a single payment and come up with. Unexpectedly you’ve got one lender money loans Cottondale AL to deal with, you to automated detachment to arrange and another matter to look on whenever counting down the days right until youre personal debt-free.

You can find credit card debt relief firms that perform this to you too, nonetheless charge fees. Property equity mortgage is a do it yourself answer to consolidate their obligations just make sure you are not favoring convenience more than prices. Quite simply, cannot tend to be a low-value interest loan on your consolidation only for simplicity’s purpose, because which could end up in you investing over you desire so you’re able to.

Your own cost could well be place and you will foreseeable

A number of the money you owe ple, more often than not comes with a changeable rate. Consequently you might features a good rates today, the firm you will definitely ratchet your interest down the line and you will probably start accumulating appeal in your established loans at one interest.

Most family collateral financing, at exactly the same time, have a fixed rates . Whatever interest rate you get today is the same rate of interest you’ll have to your entirety of your loan. Actually, you are able to a calculator to find out just how much you can easily owe monthly towards the mortgage even before you formally remove it.

Let us make use of the a lot more than example. The modern mediocre rate of interest to possess a great 10-season repaired-rate home security financing is nine.09%. If you got away a $twenty two,000 mortgage at this speed, you might shell out $ four weeks and you may shell out a total of around $eleven,five-hundred from inside the appeal costs.

The bottom line

Financial obligation was a pull, but it is an integral part of lifestyle for many individuals. If you have multiple resources of loans and would like to describe your own want to get out of debt, consider using a home collateral mortgage to pay off that which you owe. Just be sure you really have a want to repay it and you can stick to it your home is your equity on a property guarantee mortgage, so if you you should never make your repayments could cause losing your house.