- What exactly are mortgage closing costs?

- Popular settlement costs to have consumers

- Prominent settlement costs to possess manufacturers

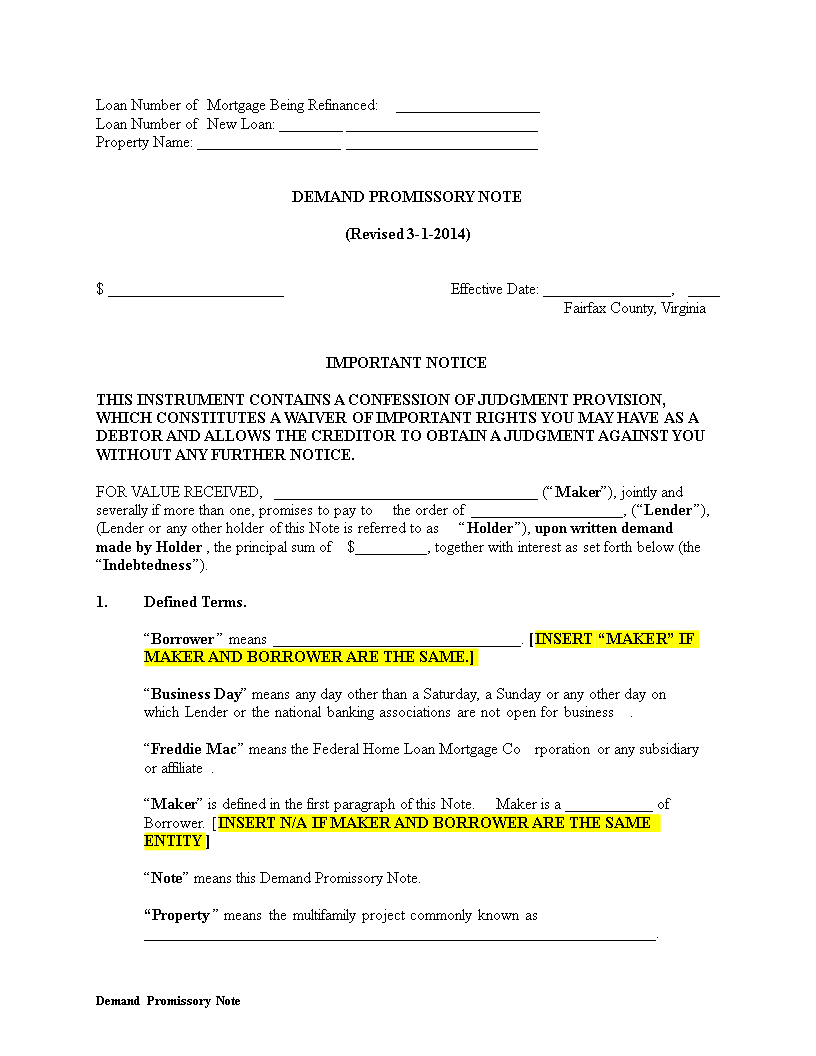

- Closing costs getting refinancing

- Tips guess and relieve closing costs

Member links toward activities in this post are from couples one to compensate you (get a hold of all of our marketer revelation with the help of our listing of couples for more details). But not, our very own feedback is our personal. Find out how we speed mortgage loans to enter objective ratings.

- Financial closing costs protection anything from assessment charges to help you questionnaire fees so you can term insurance policies.

- You’ll likely pay many in closing can cost you, however, wanting lenders and negotiating will allow you to pay reduced.

- State governments and some lenders render fund otherwise grants to greatly help that have settlement costs.

When you get a house, you need to cover one or two major upfront costs: your own downpayment additionally the closing costs that include the mortgage.

The down payment feels as though a deposit toward your residence. Settlement costs, on top of that, see various third parties on the exchange – the latest identity organization, their agent, the appraiser, an such like. Here is what to learn about these types of will cost you.

After you refinance their mortgage, you’ll be able to spend many of the same charges you probably did after you to start with got the actual financing. These could are financial charge, appraisal charges, term insurance, bodies charges, and much more.

Zero real estate earnings

You will never you prefer an agent in order to refinance your loan, so that you wouldn’t are obligated to pay income this time around. This can notably lower your can cost you.

Tips imagine and reduce closing costs

Are available to the closing costs is important, as they loan places Candlewood Shores usually total a fairly highest sum. To do so, you could potentially:

Discover the loan imagine

Whenever you are basic looking a loan, loan providers provides you with financing estimate setting, that will break apart every estimated will set you back for each and every financing will come with. You need so it to locate a crude evaluate in your settlement costs, and to contrast loan options and you can lenders.

Check your closure revelation

Your own lender must make you a closing disclosure zero later than 3 days in advance of your own closing date. It will outline every settlement costs you can owe, as well as how far currency you happen to be likely to bring to closing.

Discuss your own closing costs

Inquire the lending company whenever you waive otherwise spend less towards the financial fees, like the application commission otherwise origination commission.

You’re going to have to spend costs which go into 3rd-team companies for instance the appraiser and you may domestic inspector. But the number for the loan estimate are probably into the lender’s well-known vendors – definition you never always have to use one organization. You can look to other manufacturers one charges smaller.

Check around for loan providers

Every lenders charge different fees, so find your own bank cautiously. Like their top 3 or 4 loan providers and get for every to own financing guess. You will then manage to examine how much cash you would spend that have each bank. Ideally, you’ll find a loan provider one fees seemingly reduced fees and you may an excellent low interest rate.

If for example the best lenders haven’t any assistance programs, look for funds and provides in your condition. For each U.S. county has an application to have earliest-time homebuyers whom qualify.

Certain loan providers allow you to roll the closing costs to the loan, but end up being warned: It grows the loan harmony and you may causes higher monthly obligations plus long-identity interest costs.

Specific closing prices charge, also mortgage affairs and you will prepaid service notice, could be tax-allowable. Correspond with a taxation elite group getting specific recommendations.

This will depend for the numerous facts, you could generally expect to pay anywhere between dos% and 5% of one’s loan amount in conclusion will set you back. You can make use of a home loan closing costs calculator to find a great more precise estimate.

Sure, refinances feature closing costs, exactly as first mortgage loans carry out. You will definitely shell out dos% to 5% of amount borrowed when refinancing.