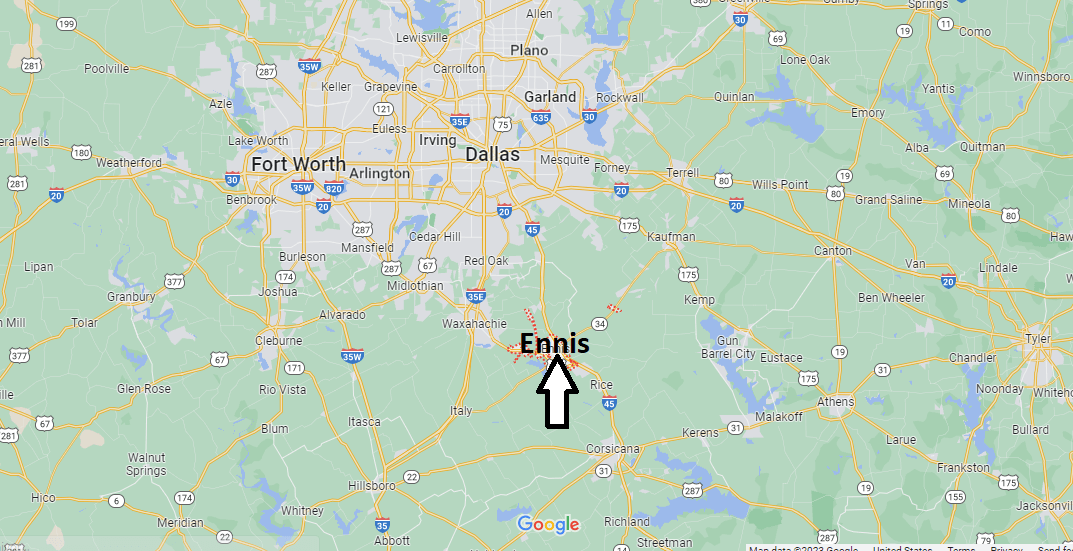

- USDA loans: The fresh You.S. Agencies out of Agriculture has the benefit of USDA fund readily available for outlying and you may suburban home buyers which fulfill specific income conditions. These types of financing give 100% resource, definition no advance payment is necessary, and then have competitive rates of interest

Condition and you can local governing bodies often offer apps specifically for very first-date homebuyers, for example down payment assistance (DPA) fund and you may provides, closure rates guidance, and house customer degree, for every and their very own band of very first-day house client financing conditions.

- DPA finance and you will provides: Advance payment guidance can come when it comes to an extra home loan otherwise an offer. If you are finance must be paid-commonly at exactly the same time on financial-has need not feel paid off. Eligibility standards are very different however, have a tendency to tend to be money limitations and you may achievement from an excellent homebuyer degree movement

- Closure costs assistance: Of a lot condition and regional software give next mortgage loans otherwise provides to cover settlement costs. For example DPA programs, such always want consumers to meet particular criteria, such as for example income limits and you will very first-go out visitors status

- Domestic visitors studies: All these programs want players to-do an effective homebuyer training path as an element of their earliest-time house consumer loan criteria. This type of programmes assist consumers understand the duties away from homeownership, and additionally budgeting, keeping property, and you may knowing the regards to their mortgage.

The needs to help you qualify for a primary-date household client give trust the latest downpayment assistance apps offered where you live.

All over the country household consumer software promote a number of options to basic-time home buyers across the country. Some of these programs are specially designed for specific categories of some body and buying specific form of attributes, and they will incorporate their unique number of earliest-date domestic buyer financing criteria.

The brand new You.S. Agencies out of Houses and you may Urban Advancement (HUD) operates the great Neighbors Next door program, providing significant offers into house having public team instance instructors, firefighters, EMTs, and you will police officers. Eligible anybody can discover a cost savings away from fifty% off the checklist price of a house in the revitalization areas. Reciprocally, the buyer must commit to residing the property because their sole home for 3 years. Although this system features its own selection of qualifications, it’s really worth listing these may vary off normal earliest-go out household customer mortgage criteria.

HomePath Ready Visitors

Fannie Mae’s HomePath Able Consumer program is designed for basic-date homebuyers who intend to pick a HomePath property. Immediately after finishing an online homebuyer education movement, eligible buyers can discover as much as step three% to summarize rates advice on the acquisition of a good HomePath assets. Home one to Fannie mae provides foreclosed towards certainly are the functions from inside the this option.

Energy-Productive Home loan (EEM)

A power-Effective Home loan (EEM) is a national system that allows home buyers, and those conference first-time house visitors financing standards, to finance the cost of and also make energy-successful advancements to a different or established family as an element of its FHA, Va, or traditional home loan. The theory trailing this program is always to spend less on power bills, which will surely help counterbalance the a lot more financial pricing. So you can qualify, this new advancements have to be pricing-productive, definition the bucks protected on opportunity expense will be meet installment loans in Virginia or exceed the price of your own advancements.

Indigenous Western Direct Financing (NADL)

New Indigenous Western Direct Mortgage (NADL) program are a Virtual assistant-supported program giving qualified Indigenous Western Pros and their spouses the opportunity to explore their Virtual assistant financial warranty work for on government faith property. The applying now offers benefits, as well as no advance payment, a low interest rate, and you can minimal closing costs. The buyer need certainly to want to occupy the house since their first residence.