Moms and dads might need to reconsider plans to help college students finance a good household given that expensive finance chew. Shopping for a less expensive home loan is important in the event you normally.

Bank regarding Mum and Dad (BOMD), one of the country’s greatest assets lenders, is in problems as of many students who were assisted to buy property today challenge on account of ascending rates of interest and cost-of-bills. This type of demands was putting at stake the fresh new monetary appeal of the parents.

Over fifty percent BOMD consumers try significantly less than monetary be concerned (in which expenses exceeds money), weighed against in the 28 percent from property customers exactly who relied on their own info, states Martin North, dominating from Electronic Money Statistics (DFA), a separate consultancy.

Certain younger people borrowed maximum numbers when interest levels have been within list downs and so are not able to fulfill improved repayments following the previous round regarding grows (eg people who grabbed away you to definitely- as well as 2-year fixed costs which might be going to the conclusion its terms), Northern claims.

People that fool around with BOMD to access the brand new housing marketplace also are likely to own quicker exposure to dealing with money, budgeting and you may protecting. Meaning they were already very likely to enter economic difficulty, the guy adds.

Parents just who lent places, provided bucks, made use of security in their own household otherwise underwrote places to help kids pick a first domestic are also under pressure since the their investment base and money streams was indeed less, which impacts their ability to help you help their children once more, North contributes.

The newest unregulated bank try estimated getting among the nation’s top types of homes deposits, that have mediocre numbers for every single BOMD-financed financial in the $89,100 within top out of history year’s possessions increase, DFA says.

Fund are believed so you’re able to full regarding $thirty-five million, more this new Australian businesses of Citigroup otherwise HSBC Australian continent, DFA claims.

Refinancing is anticipated to boost quickly due to the fact fixed-price funds (and additionally funds separated between repaired and you will variable costs) value more than $450 billion was owed to have revival along side next 1 . 5 years, a diagnosis out of bank abilities reveals

Kirsty Robson, a monetary counsellor from the Consumer Step Rules Hub, says she regularly works together with elderly customers up against financial worry because he’s got responsibility for their children’s costs.

Amplifier Financial studies and additionally features expanding concern among consumers, instance individuals who ordered a home in the past season whenever pricing was indeed within number highs.

It finds one one or two-thirds off possessions people are worried throughout the fulfilling their mortgage repayments and therefore are lowering to the as well as outfits to make comes to an end satisfy.

There have been half dozen straight speed increases in the past half a dozen months, resulting in national mediocre pricing to drop in the 5 per cent of December highs that have drops inside the Sydney of about nine per cent and in Melbourne almost 5 per cent, says CoreLogic, and this inspections assets rates.

Time immemorial out of just last year, the number of basic homebuyers have almost halved, as number of people refinancing has grown in the 23 each cent, states AFG, brand new noted large financial company.

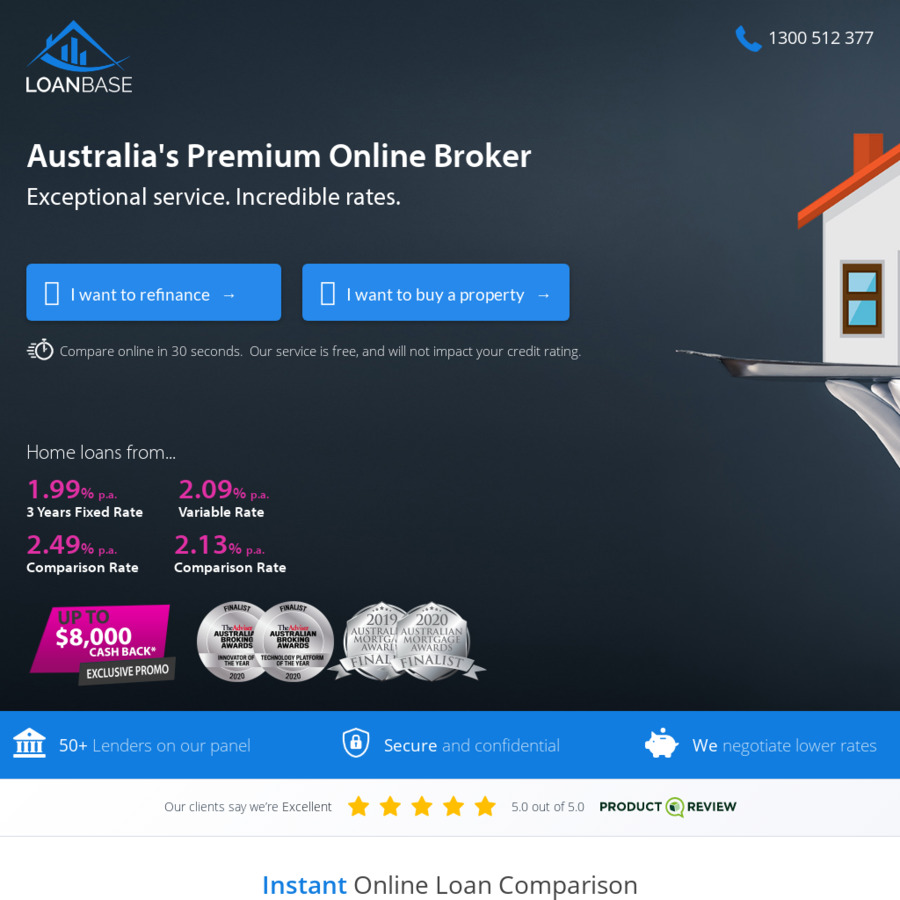

Really fixed rate fund have been secured inside whenever pricing was in fact anywhere between 1.95 % and you can dos.09 percent due to the fact cash costs dropped to help you 0.step 1 per cent.

Lendi, other large financial company, states how many refinancing concerns leaps more than 150 for every penny to your basic Monday of any month, if the Reserve Lender out-of Australia meets to look at dollars speed grows.

Owners whoever security drops less than 20 percent is actually stuck that have the newest lenders’ terms and conditions, and generally are ineligible to possess lucrative bonuses and you may mortgage deals offered so you can the fresh individuals of the contending lenders.

Further, of a lot consumers (including people who took aside large fund whenever costs were within current list lows) are also are squeezed from the step three % serviceability shield specified from the Australian Prudential Control Expert, used by loan providers to assess ability to handle rising will cost you.

In APRA fret shot, brand new home financing candidates need certainly to inform you they can pay for month-to-month money at around three percentage facts more he is making an application for, or perhaps the bank’s pre-place floors speed (any sort of was highest). A floor price ‘s the lowest rates a debtor is energized online installment loans Idaho.

Loan providers always to change rates adopting the Oct cash rate boost, however the reasonable rate try 4

This means a primary-and-appeal, owner-occupier debtor with a twenty-five-12 months, $one million mortgage refinancing to just one of low rates from cuatro.09 % that it week is going to save almost $twenty-four,one hundred thousand more than 2 years.

Try to stick to your existing mortgage identity and then make even more costs to invest it well as quickly as possible, claims RateCity’s Sally Tindall.

Lenders try passage with the full nature hikes to their variable rates but reducing their also offers for brand new consumers, claims Tindall in the why individuals should think about a different financial.

Likewise, from the 31 loan providers have to offer mortgage cashback offers to attention this new people anywhere between $1500 so you can $10,000, subject to loan dimensions.

Refinancing was roaring since the somebody seek lower rates that’s forced the banks to get ideal rates available, states Tindall. The catch are, they are only offering these types of pricing to the people prepared to dive boat.

Mortgage brokers claim competitive loan providers was slashing doing dos.8 commission facts regarding simple varying pricing, and that cover anything from regarding 3.54 percent in order to eight.39 per cent, centered on Canstar, which inspections pricing.