Delivering a mortgage in Dubai to possess expats and you may nationals are an important aspect when selecting houses or accommodations in Dubai. For those who take into account the significant number from expatriates currently traditions or who are seeking surviving in the latest UAE down the road, they may need a house that’s suitable for its individual taste and suits the individual economic requirements.

Because multiple everyone is trying to get a home loan during the UAE, we have submit an extensive and you may detail by detail selection of investigation that can direct you on how best to rating fund for purchasing property in the Dubai.A few of the big systems when you look at the UAE such as for example DAMAC Mountains and you can DAMAC Slopes dos. Dubai keeps an incredibly attractive capital ecosystem, especially in a home. Dubai is called one of the better towns in the business for various circumstances, such lifestyle, travelling, and you will investing. It also holds new title of safest town about world. It’s got a personal, monetary and you may solution-friendly environment that offers residents and you may dealers many advantages perhaps not discover in other countries, therefore it is one of the most glamorous metropolises to find a number of industries, especially a house. DAMAC properties bring Flats Available in Safa That americash loans Boulder, and you may step 1 BHK Flats Obtainable in Safa You to.

Guidelines Getting Expatriates Discover Lenders In the Dubai

Into the UAE, loan providers are required to conform to a certain criterion so you can provide loans for home inside the Dubai. They are:

- Credit rating

- Amount of a career inside UAE

- Big date spent in UAE (Always off six so you can 12 months)

- Overall business months inside UAE (Usually three years)

Pre-Requisites For buying Home loans Within the Dubai

Because the a person can expect, mortgages and mortgage brokers was seemingly prominent into the Dubai and lots of clear laws and regulations were elaborated by main lender out of UAE. To have expats, home loans when you look at the Dubai were provided on particular conditions.

The first step contained in this crucial techniques are studying the newest amount of money you have to pay upfront. Besides that, you are required to have a good idea of your own time of the borrowed funds as well as if you require the most a predetermined or changeable attract. This type of extremely important factors need to be considered by the a keen expat who wants to acquire mortgage loans within the Dubai.

Out-of a monetary position, there are couple payments you to definitely expats need to pay to possess getting fund to have residential aim when you look at the UAE.

- You have to pay an about twenty five% of the complete purchase price getting an advance payment (normally, this is to have functions that are below AED 5 million).

- 25% of one’s mortgage registration percentage

- 4% import commission, Valuation payment (nearly AED step 3,000)

- 2% commission for real home.

Earlier in the day Acceptance To have A home loan

For many who would like to purchase property inside the UAE, it is essential to get previous mortgage acceptance. This will help provide you with an exact confirmation out-of their complete funds, that is pivotal because makes it possible to choose a property to manage.

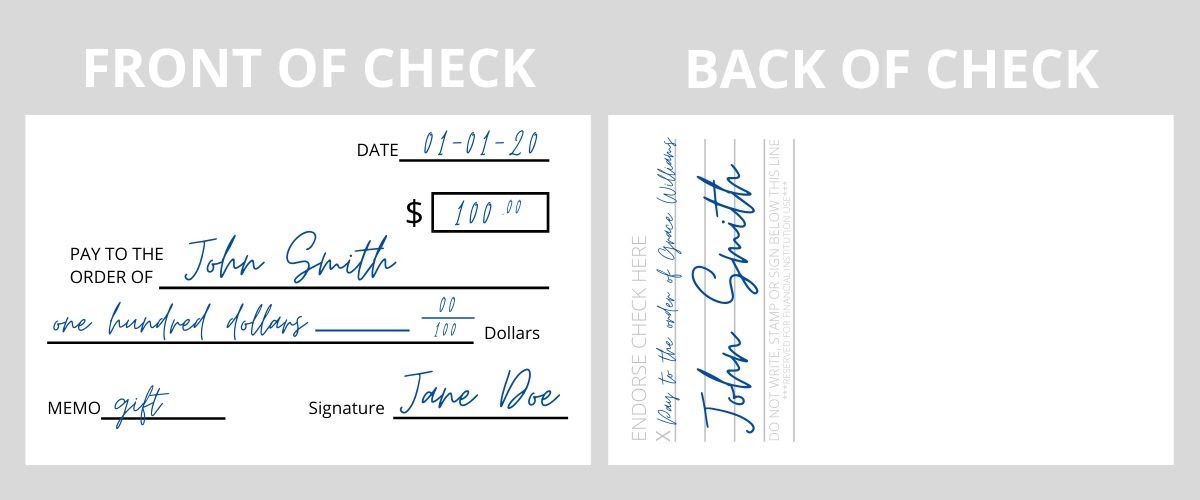

Apart from that, when you need certainly to indication a binding agreement on income out-of the house or property, you might have to give a finalized cheque. This ought to be almost ten% of the property’s price. But not, if you have perhaps not received financial acceptance, you may really cure the latest bank’s put money.

You should make sure the arrangement has a clause to own property valuation. Just before your financial institution offers any financing, they would feel performing an effective valuation of your property. In some instances, the brand new valuation can lead to a fact versus genuine buy cost of the property.