Great things about HELOCs:

Flexibility when you look at the credit and payment: You could borrow funds as needed and pick and also make desire-simply money in draw months, taking better independency compared to family equity financing.

Pay just interest towards the amount borrowed: With a HELOC, you only pay attention toward financing you truly play with instead than the whole loan amount.

Right for lingering costs otherwise programs: An effective HELOC will be the best choice when you yourself have good enterprise or expense that really needs financial support more a lengthy several months.

Disadvantages regarding HELOCs:

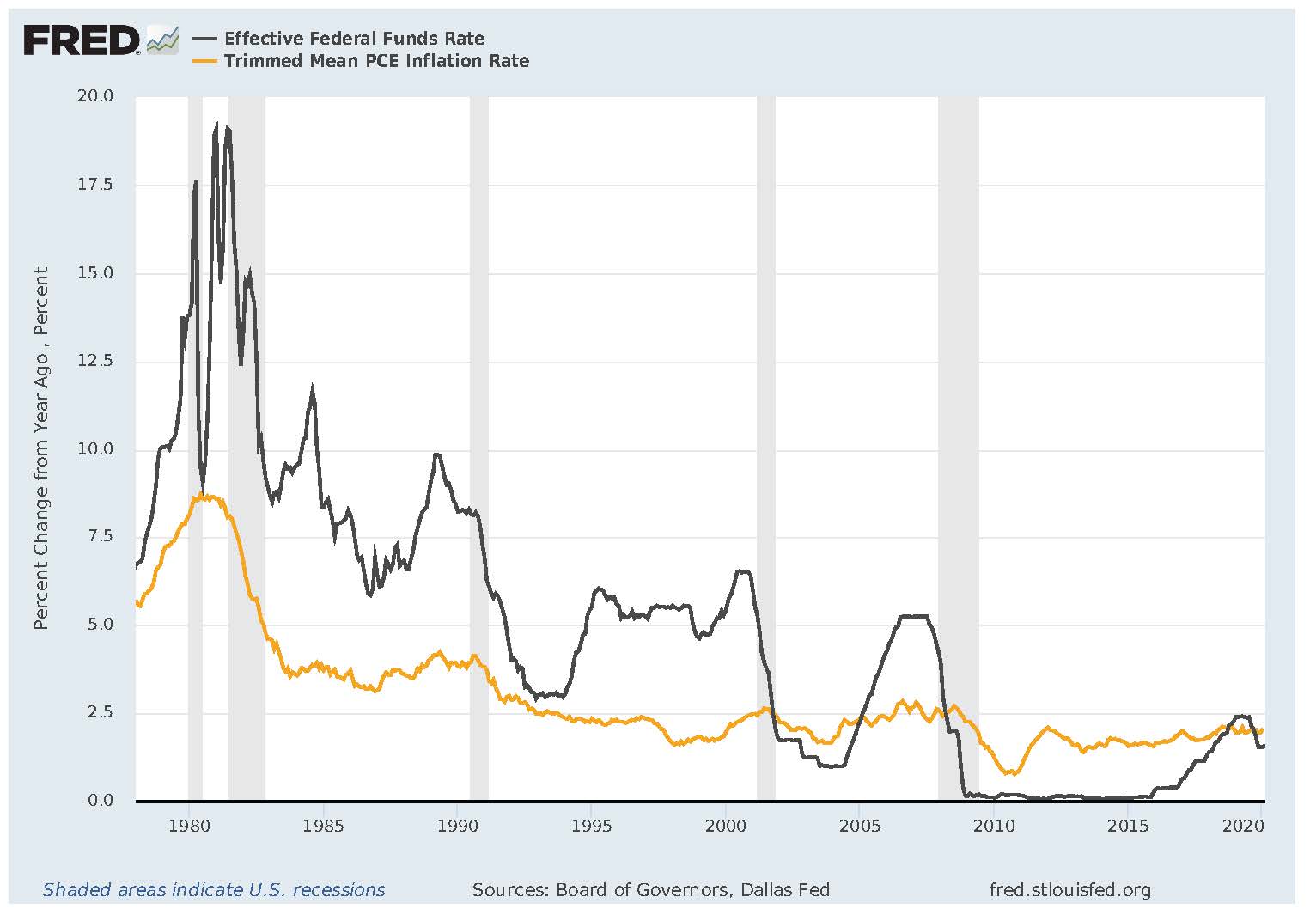

Variable rates of interest get increase throughout the years: If field interest rates rise, the monthly premiums may improve, so it’s more complicated so you can plan for your loan payments.

Potential for overspending: The flexibility loans Wray CO of a beneficial HELOC may lure you to definitely use alot more than simply you prefer, leading to increased financial obligation and higher monthly payments.

Risk of foreclosures: As with property security loan, defaulting on the HELOC costs you’ll put your house at risk off foreclosure.

While looking for an excellent HELOC, examine rates of interest, settlement costs, and fees conditions regarding several loan providers. In addition to, check out the amount of the mark months and you will any fees relevant with the loan, for example yearly fees or very early closing charge.

When determining ranging from a property equity mortgage or HELOC, it is important to consider carefully your individual finances and you may specifications. The purpose of the loan is a vital basis to save at heart. If you want fund to own a big, one-go out bills including house renovations or debt consolidation reduction, a home equity loan will be the better choice. Additionally, for those who have constant expenses or a project that requires financial support over time, a good HELOC are more suitable.

Interest rates and private exposure tolerance including enjoy a critical part on the decision. Household equity finance provide repaired rates of interest, providing stability and foreseeable monthly premiums. Conversely, HELOCs features variable rates of interest that will change-over date, and that’s beneficial in the event that costs decrease however, risky if the rates increase. Think about your exposure tolerance and you may whether you desire the newest confidence away from fixed rates or the prospective great things about changeable prices.

Cost words as well as your budget are also crucial what to examine. Household security financing possess repaired repayment terms and you will monthly installments, and then make cost management convenient. HELOCs offer independence which have attract-only repayments in the draw several months, but monthly premiums can increase somewhat while the repayment months begins. Determine your finances and money move to determine and this option better aligns together with your finances.

Finally, the borrowed funds can cost you, including settlement costs and you will costs, should be thought about when comparing house guarantee loans and you can HELOCs. Each other alternatives might have settlement costs, instance assessment charges, origination costs, and title research charge. Specific loan providers ounts or you see certain qualificationspare the entire costs of each and every loan choice, together with interest rates and you can fees, to decide which is way more rates-productive to meet your needs.

In the course of time, the choice anywhere between property security financing or HELOC depends on your specific financial products, the goal of the borrowed funds, along with your private choice. Within iTHINK Monetary, we have been here so you can browse this choice and acquire the newest services that works well best for your needs. If or not you decide on a house security financing otherwise HELOC, all of us is preparing to work with you every step of method. Use on the web today otherwise head to our local twigs to consult an educated member and start getting your house equity to your workplace for your requirements.

Mark and you may repayment attacks: When you look at the draw months, you may make attract-simply payments towards the amount borrowed. Because draw several months stops, the fresh new payment period starts, and you might generate dominating and you may interest costs to pay off the newest financing.