The brand new Aavas financial calculator facilitates simple calculation of your house Loan Equated Month-to-month Cost (EMI). By using Aavas’ EMI calculator to possess home financing, you could obtain extremely important information to make a proper-informed choice when deciding to take a mortgage.

Qualification

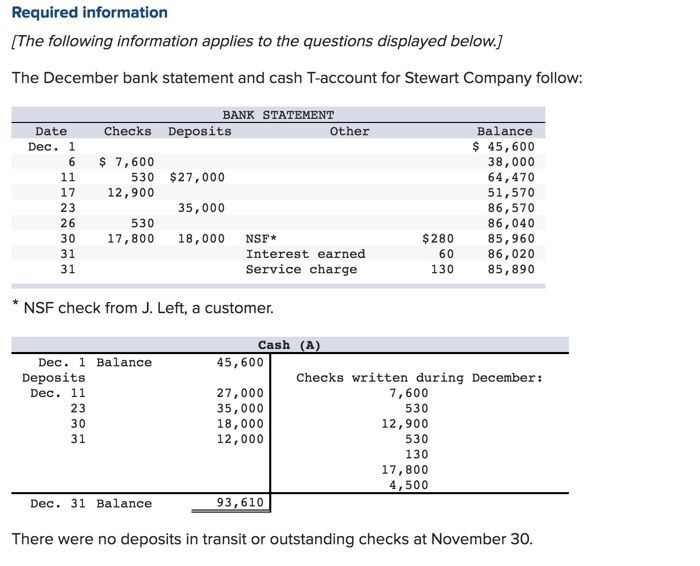

Financial Amount | 1L | 5L | 10L | 15L | 20L | 25L | 30L | 1L | 10L | 20L | 30L Interest rate Mortgage Period Monthly payment(EMI) Total Desire Payable Full of Payments (Dominant + Interest) Get Mortgage EMI Break up Sign up for Financing

Everybody has an aspiration having a space of their or her own, getting in touch with it household. To americash loans Midland City do so objective, the simplest way is to take a home loan. You will find a simple-to-shell out financial EMI that produces the brand new cost techniques convenient and you will comfortable. AAVAS mortgage EMI calculator will say to you the degree of month-to-month EMI within taps. All you need to enter ‘s the needed casing loan amount, total tenure for the no. out of years or weeks, while the interest on the mortgage EMI calculator. This online financial calculator can be so effortless one to anyone can utilize it. It is possible to discover EMIs for different decades and different costs of interest depending on the needs. Such EMIs are going to be sometimes repaired or drifting and are generally payable monthly. The new calculation from EMIs is additionally super easy. Making this type of data beforehand is the greatest method of getting the new best houses financing EMIs that assist one to bundle your funds consequently. While together with prepared to get home financing, you are able to the brand new Aavas financial EMI calculator to understand how much cash EMI you would be expected to spend. Making your financial decisions assured and you can financing planning smoother, make use of the most trusted Aavas property mortgage EMI calculator.

Just how do home loan EMI calculator make it easier to?

A property loan EMI calculator really helps to determine the newest EMI you to a borrower should spend per month to your lender otherwise the lending company before the full home loan tenure closes. To possess earliest-day consumers, figuring the brand new equated monthly installments are going to be an elaborate task however, not anymore to the Aavas online free EMI Calculator to own Family Loan. Using this home loan calculator, profiles may do complex data without difficulty, precision, as well as in no time at all. This on line mortgage EMI calculator provides exact overall performance that help you plenty on the economic believed.

Strategies for Effectively Playing with Financial EMI Calculator:

- See the key axioms before you use the web Aavas EMI calculator including the financing tenure, home loan interest, while the loan amount. This helps input the correct recommendations yourself loan EMI calculator.

- Read the EMI towards various other financing numbers, tenures, and you can interest levels to know the way it influences all round EMI. Using an online EMI calculator a variety of combos do make it easier to find the the one that tend to line-up together with your financial features and needs.

- Consider and you will comprehend the EMI amortization plan which had been generated if you utilize the new EMI calculator. Using this, you’d arrived at understand the post on most of the EMIs comprising the eye and dominant section for the whole mortgage tenure.

- Find the EMI alternative that suits their month-to-month budget. You should save yourself from whatever monetary filter systems. It is important to select the correct EMI to repay the fresh new financing comfortably.

- Make sure you are able to possess consistent and you may quick EMI money. Any kind of decelerate within the EMI money normally harm your own credit score and will cause penalties. For it, it’s important to setup automated repayments to possess monthly EMIs to cease any issues.