- Enough Security having 2nd Purchase: High guarantee offer a hefty downpayment for your next domestic, making the change much easier.

- Level The Debts: When you yourself have sufficient security, the sales proceeds might https://www.cashadvanceamerica.net/title-loans-mo help pay the remaining mortgage balance and perhaps most other debts, such as playing cards or signature loans.

- Business Time: People might decide to sell whenever collateral are large, taking advantage of advantageous market standards to optimize the come back.

Collateral and you will Mortgage payment

One a good financial harmony is usually reduced regarding marketing proceeds through the property purchases. High guarantee guarantees you could potentially comfortably cover it home loan benefits and possibly has money left-over.

Skills your house’s security and its particular affect the sale techniques is key to making informed decisions and considered effortlessly to suit your financial coming.

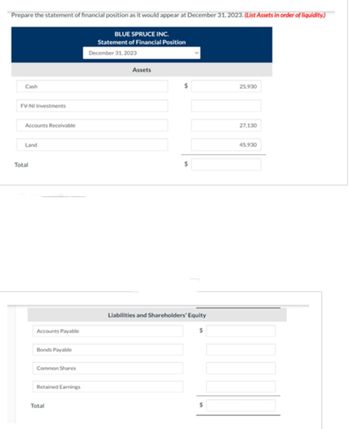

Choosing just how much guarantee you will want to sell your property is crucial for a successful and economically voice household deals. The amount of equity requisite can differ based on multiple points, together with your financial needs together with expenses associated with offering.

Examining Called for Security

- Covering A fantastic Mortgage: Preferably, your own guarantee can be adequate to repay the remainder home loan equilibrium. This is the lowest collateral wanted to end getting cash to help you brand new closure dining table.

- Flexible Attempting to sell Costs: Account fully for closing costs, real estate professional charge, and other expenditures. Generally speaking, these will cost you can vary from six% to help you ten% of your sales price.

- Planning for another Get: If you intend to shop for yet another house, think about the security you’ll need for a deposit in your next financial. So it usually determines minimal fashionable collateral matter.

Facts With Reduced otherwise Negative Guarantee

- Bad Guarantee: For folks who are obligated to pay over the current market value of your own household, you may have to talk about choice for example an initial deals or keep strengthening collateral before attempting to sell.

- Reduced Security: With just minimal security, you do not build enough regarding purchases to pay for every expenses and really should examine if promoting was financially feasible.

Strengthening collateral of your house is a switch technique for increasing your financial get back when you decide to market. Here are some good ways to enhance your residence’s security:

And make Most Mortgage repayments

Spend over the minimum monthly home loan count. Even brief most money can reduce the principal harmony reduced and you may generate equity.

Regularly remark the home loan comments to trace your progress and stay determined. Finding out how for each payment impacts your own prominent and you may appeal might help you make told behavior on the more payments.

Improving Value of

Put money into do-it-yourself plans you to boost your home’s worthy of. Work on home improvements with a high investment yields, eg cooking area or restroom updates. Along with, think preserving your home in the expert condition. This will help to manage its really worth and you will contributes to security development.

Normal repair and you will timely fixes can prevent brief items out of as expensive issues, thereby sustaining the property’s well worth. Land and you can curb attention improvements can also rather boost your residence’s marketability and you will observed really worth.

Refinancing having Top Conditions

Refinancing so you can home financing with down rates can help you lower the principal reduced, particularly if you maintain the same monthly payment.

When it comes to refinancing, gauge the settlement costs and ensure your much time-identity deals exceed such expenses. It’s also beneficial to consult with a financial advisor understand brand new taxation ramifications as well as how refinancing fits in the overall financial package.

Keeping track of Industry Requirements

Remain advised concerning real estate market in your area. Increases when you look at the market price is passively boost your house’s collateral.

Staying abreast of local zoning change, coming innovation arrangements, and you may monetary styles may also bring understanding of future increases inside the worth of, assisting you to build strategic conclusion regarding your family investment.