If a company try, or is to reasonably keep in mind off pointers gotten in the app process, that there have a tendency to, or will most likely, be upcoming transform on income and you will expenses of customer when you look at the name of one’s controlled home loan package or household get package, the organization has to take them into consideration whenever evaluating whether or not the customers will be able to spend the money for figures owed towards purposes of MCOB eleven.six.dos Roentgen .

six.fourteen R are: reductions in money that happen following customer’s later years; in which it is known that customer has been produced redundant; otherwise the spot where the corporation understands another type of financing union you to can be due for the name of the controlled mortgage package or household buy package, instance a guarantee mortgage to help with assets buy.

In case the identity out of a managed home loan deal otherwise house buy plan carry out offer outside of the go out about what the consumer anticipates so you can retire (or, where that go out isnt known, the state pension many years), a firm should take a prudent and you will proportionate method of evaluating the user’s income beyond you to definitely go out. The level of analysis as adopted may differ based on the period of time remaining to advancing years if assessment is actually generated. The brand new closer the customer is to try to retiring, the more sturdy the data of your own quantity of income from inside the later years would be. Eg, in which advancing years was age down the road, it could be sufficient just to establish the presence of particular pension supply towards buyers by the requesting facts such as good retirement report; where in actuality the consumer is almost later years, the greater amount of powerful measures may cover provided asked your retirement income of a retirement report. Relative to MCOB eleven.six.12R (1) , a firm should bring a common sense see when evaluating people recommendations provided by the customer into the his expected advancing years big date.

In which a supplementary mortgage partnership is expected to be owed throughout the term of one’s managed mortgage offer or family buy plan, the mortgage bank is evaluate whether or not the controlled mortgage deal otherwise household buy package will continue to be affordable if the mortgage union will get owed, unless of course there was an appropriate fees method in position to repay a loan, including from the product sales of the house the topic of the controlled financial contract or household purchase package.

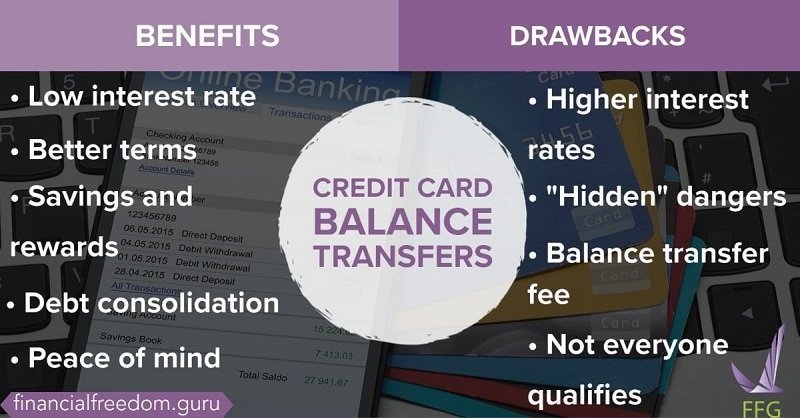

Debt consolidation and you may borrowing-dysfunctional customers

Subject to (3), where all the conditions into the (1) try fulfilled and you can, whether your expenses which are become repaid utilizing the amounts increased by the controlled home loan package otherwise family purchase package (or adaptation) just weren’t paid down, the transaction wouldn’t be affordable with the buyers, the organization has to take sensible tips to ensure that, towards end of one’s transaction, the individuals expenses are actually paid back.

The necessity for the (2) cannot apply in case your agency have believed your customer’s existing costs which can be becoming reduced with the amounts raised because of the managed home loan package otherwise home purchase plan (or variation) does not in reality getting paid off and you may, accordingly, were them once the committed cost on the affordability analysis toward buyers.

Whenever determining new affordability from a retirement notice-just financial having mutual loans in Hillsboro consumers, the firm should think about the ability of one debtor in order to continue making the needed payments if for example the other becomes deceased, looking at associated proof such as pensions payable with the enduring lover otherwise municipal companion

The requirement from inside the MCOB eleven.6.16R (2) getting practical steps tends to be fulfilled by the mortgage lender’s, or household pick provider’s, paying off the fresh the amount of time costs to this new loan providers worried because good reputation of granting the latest regulated mortgage package or house buy bundle.