Within the a young overview of Loan against Assets, we’d talked about the product in more detail. In this article, i take a look at Financing against property device regarding Condition Bank out of India.

- Loan amount up to Rs eight.5 crores

- Loan Period of up to 15 years

- Financing lengthened up against domestic and choose industrial functions

- Leasing earnings about possessions could be considered to determine mortgage eligibility

- Merely label mortgage facility readily available. Overdraft studio not available

- No prepayment penalty

- Fair financial of the home in favour of the lending company

Whenever i understand, you will not get this to mortgage to have a storyline or a lower than-structure property. There’s particular contradictory recommendations published with the SBI webpages on need of money. We all know you to definitely Financing up against Assets can’t be utilized for speculative motives. But not, on a number of towns for the SBI web site, its mentioned that the money against assets can’t be made use of for team purposes either.

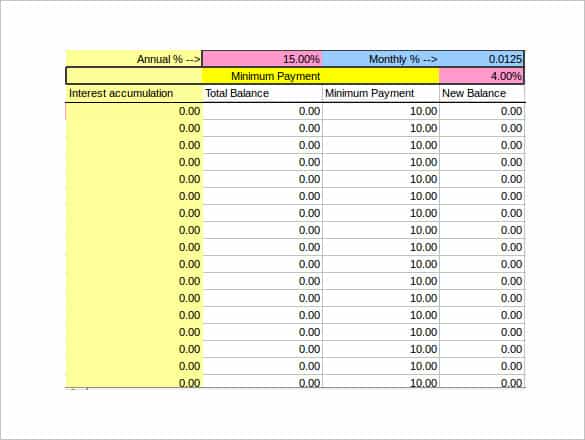

EMI/NMI Ratio

Simultaneously, your month-to-month earnings will even influence your loan repayment feature. As stated over, the bank may also imagine local rental money regarding possessions to visited your own online month-to-month income. Limitation permissible EMI/NMI is as pursue.

To increase the loan eligibility, you can attempt including co-borrowers on the financing. Needless to say, merely a co-borrower which have an income source will result in high financing qualification.

SBI Financing facing Possessions (SBI LAP): Mortgage Period

There can be tribal installment loans no credit checks and no teletrack a supplementary restrict. Mortgage around LAP must be liquidated before eldest borrower achieves the age of 70. The mortgage device it allows mortgage even for this new functions held inside title out of companion/kids/parents/siblings. For this reason, you might sign up for that loan with the property which is maybe not on your own term or where you are a mutual holder. In such cases, the people who own the house would have to sign up just like the co-borrowers. Therefore, if you have to remove financing to have a home which is kept on the identity of another partner (otherwise jointly held along with you), it will have are a shared financing. Now, on possessions held in the name out-of a mature representative of your nearest and dearest (particularly parents), it rule of restriction age of 70 could affect financing period, and you may efficiently the EMI.

What is the Rate of interest having SBI Loan facing Property?

In case your leasing/professional/providers income makes for more than fifty% of one’s net month-to-month income, you will need to shell out a higher level interesting. In my opinion, it is warranted also. Types of money besides paycheck is almost certainly not just like the legitimate. Additionally, the value of this new house can be associated with new rental money it can make.

Let`s say you own a home and you take a loan up against they. The lending company enjoys experienced the rental money to decide financing eligibility. Whether your rental earnings versions over fifty% of one’s net gain, they things to next:

Regarding the bank’s perspective, it is a two fold problem. Not only is the leasing earnings taking place however the worthy of of the house elizabeth time. While the financial institutions remain significant margin (as a result of lower LTV), the attention costs should however echo new inherent threats.

Which are the Most other Fees?

Running percentage is step 1% of loan amount at the mercy of a total of Rs 50,000. Likewise, there will be valuation charges, stamp obligation for financing arrangement and you will mortgage and you may possessions top. Excite discover the fees before signing up for the loan. GST will likely be levied to the every costs.

What Should you decide Do?

Dont borrow funds unnecessarily. If you feel that the payment of your own mortgage is going are an issue, believe attempting to sell the home than bringing a loan facing they. You will at least save well on the interest costs. Not a straightforward choice and then make however it is always greatest to keep your ideas aside. For those who has to take a loan up against assets, perform consider the has the benefit of from other banking companies also.