Consumer Conformity Attitude: Third Quarter 2013

/GettyImages-153038397-5a53bfa0494ec900369098e4.jpg)

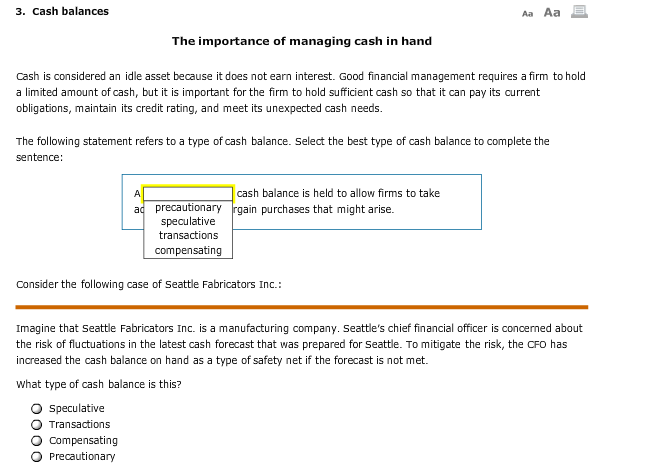

Throughout the aftermath of the economic crisis, family possessions opinions denied somewhat in many parts of the country. Responding, of several loan providers suspended family collateral lines of credit (HELOCs) otherwise smaller borrowing limitations, carrying out compliance and you may reasonable credit threats. When you’re houses cost has rebounded from the downs of your drama, financial institutions need to remain conscious of its obligations not as much as Regulation Z when a critical reduction in a beneficial property’s worthy of you to greeting good collector to take this type of procedures has been healed. Financial institutions must also acknowledge the latest reasonable financing exposure of this these procedures. This short article will bring an introduction to the compliance requirements and you will risks whenever a collector requires step towards an effective HELOC on account of a great change in property value. step 1

Controls Z Compliance Standards

Section of Control Z imposes extreme compliance criteria into the HELOC creditors. That it part not just requires disclosure regarding plan fine print and fundamentally prohibits a creditor away from switching all of them, except inside the specified points. You to definitely circumstances permitting a collector so you’re able to suspend a HELOC or treat their borrowing limit occurs when the house or property protecting the HELOC enjoy a life threatening decrease in well worth, as the considering when you look at the twelve C.F.R. (f)(3)(vi)(A):

Zero creditor can get, of the contract or else … changes any identity, other than a online installment loans Georgia collector can get… prohibit even more extensions regarding borrowing otherwise slow down the credit limit applicable to an agreement while in the one months where in fact the property value the dwelling that secures the plan refuses significantly beneath the dwelling’s appraised well worth to own reason for the master plan. dos (Stress additional.)

The newest regulation will not establish an effective high refuse. Yet not, Remark (f)(3)(vi)-6 of the Specialized Staff Opinions (Commentary) will bring creditors having a secure harbor: If the difference between the initial borrowing limit plus the available guarantee is faster in half on account of a worth of refuse, the fresh decline can be considered high, enabling creditors in order to refuse even more credit extensions or reduce the borrowing from the bank restriction to possess a HELOC plan.

When choosing if or not a life threatening decline in worthy of features occurred, creditors will be contrast this new dwelling’s appraised value at the origination from the current appraised value. The new table below provides an illustration. 3

Within this analogy, the fresh new collector you may ban then improves or reduce the credit limit in the event your worth of the home refuses away from $100,000 so you’re able to $90,000. Management is going to be mindful that while they may be allowed to reduce the borrowing limit, this new protection can not be beneath the quantity of the latest a great equilibrium if this would require the consumer making a top fee. 4

Property value Actions

The fresh new collector is not needed to get an assessment prior to reducing or cold an excellent HELOC in the event the family worth have decrease. 5 However, having examination and you may recordkeeping intentions, the newest creditor is always to retain the paperwork where it depended to help you establish you to a significant decline in value of taken place before taking step towards HELOC.

When you look at the , the fresh Interagency Borrowing from the bank Chance Government Information for Home Security Financing is actually composed, which includes a discussion out-of equity valuation administration. 6 The fresh recommendations provides samples of risk management practices to adopt while using the automated valuation models (AVMs) or taxation assessment valuations (TAVs). After that advice on appropriate techniques for using AVMs otherwise TAVs is considering regarding the Interagency Assessment and you will Investigations Guidelines. seven Government may want to look at the advice while using AVMs or TAVs to choose whether a critical refuse features took place.

And additionally regulating compliance, establishments should know about one to a great amount of group action suits was in fact registered difficult the employment of AVMs to reduce credit limitations otherwise suspend HELOCs. 8 The fresh plaintiffs in these instances have challenged some aspects of compliance, like the accessibility geographic area, rather than private possessions valuation, once the a grounds having an excellent lender’s seeking out of reduced worth; new AVM’s reliability; as well as the reasonableness of the is attractive processes set up whereby a borrower can get problem this new reduced amount of brand new credit line. Within the light associated with legal actions exposure, what is important getting institutions to pay attention so you can conformity criteria.