A home loan not only makes to acquire property more available and in addition also offers significant taxation experts. These types of income tax positives ease your financial weight by eliminating taxable money, saving you currency while you are settling the loan. For example, not as much as Area 80C, you can allege an effective deduction as much as Rs. one.5 lakh a year to the dominating fees of your property mortgage. These types of benefits convenience your financial weight when you’re working for you get to deals and you may economic requirements effectively.

The amount of money Taxation Act brings welcome relief below various sections, fulfilling individuals to own investing a house. Of deductions towards appeal repayments so you’re able to dominating money, home loan taxation professionals let do value when you are strengthening long-identity possessions.

Financial positives beneath the dated tax techniques remain unchanged, enabling consumers to help you claim write-offs versus limits. But not, the brand new income tax techniques features restricted such pros. Is a breakdown:

- Write-offs under Part 80C having dominating fees, stamp duty, and you will registration charges, in addition to less than Parts 80EE and you may 80EEA, commonly available.

- Lower than Section 24(b), the latest deduction to have appeal into the home loans isnt designed for self-filled attributes.

- Getting help-away qualities, write-offs below Area 24(b) arrive. In case your net gain regarding an enabled-aside assets causes a loss of profits, it losses are going to be counterbalance up against payouts from other home features however, cannot be adjusted up against earnings of paycheck or any other supplies.

Home loan income tax experts not as much as Point 80C & Part 24

Government entities away from Asia expands these benefits as the a type of save so you’re able to consumers, and work out house purchase inexpensive. Towards availing a home loan, you really need to generate month-to-month payment in the way of EMIs, which include two priount and attention payable. The fresh new They Work permits consumers to love taxation pros towards one another these types of portion privately.

1. Part 80C

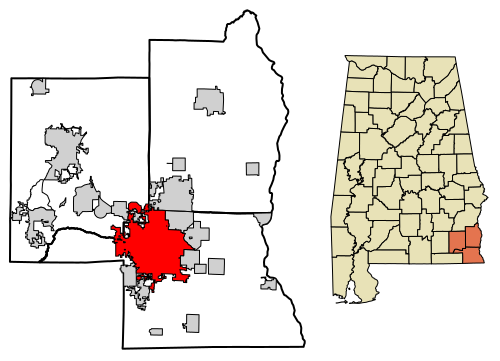

Part 80C is one of the most are not used parts of the amount of money Taxation Work. It https://paydayloanalabama.com/pike-road/ permits taxpayers to claim deductions definitely opportunities and you can costs, such as the dominating payment from a home loan.

- Allege an optimum financial taxation deduction as high as Rs. 1.5 lakh from the nonexempt earnings on the dominant fees

- It p duty and membership charges but could feel said just once and also in the same year they are sustained. Part 80C of your own Taxation Operate during the Asia will bring write-offs without a doubt specified investments and you can expenditures

2. Section 24

Point 24 concentrates on the interest element of your property loan repayment. It section brings extreme rescue to have consumers by providing deductions dependent for the objective and you may achievement updates of the home.

- Deduction to Rs. 2 lakh: Taxpayers can also enjoy an optimum deduction of up to Rs. 2 lakh into the appeal number payable to possess a home loan. Which deduction applies to have functions whoever design is carried out within 5 years.

- Restricted deduction when the build maybe not finished in 5 years: In the event your structure of the property is not complete during the given five-seasons several months, the maximum deduction minimizes in order to Rs. 30,000 as opposed to Rs. 2 lakh.

Home loan Appeal Deduction

Section 80EE lets taxation pros for the attention portion of the fresh new residential domestic possessions loan availed away from one lender. You could potentially allege a mortgage focus deduction as much as Rs. 50,000 per monetary year according to that it point. You could potentially continue to allege if you don’t enjoys totally paid down the fresh new mortgage. The brand new deduction below 80EE is applicable merely to people, meaning that when you are an effective HUF, AOP, a company, or other form of taxpayer, you can’t claim the main benefit lower than that it part. In order to allege so it deduction, never very own any household property into the go out of your own sanction regarding a loan. Make use of the home loan EMI calculator so you can estimate your property mortgage EMIs.