Step 1 – Software Process

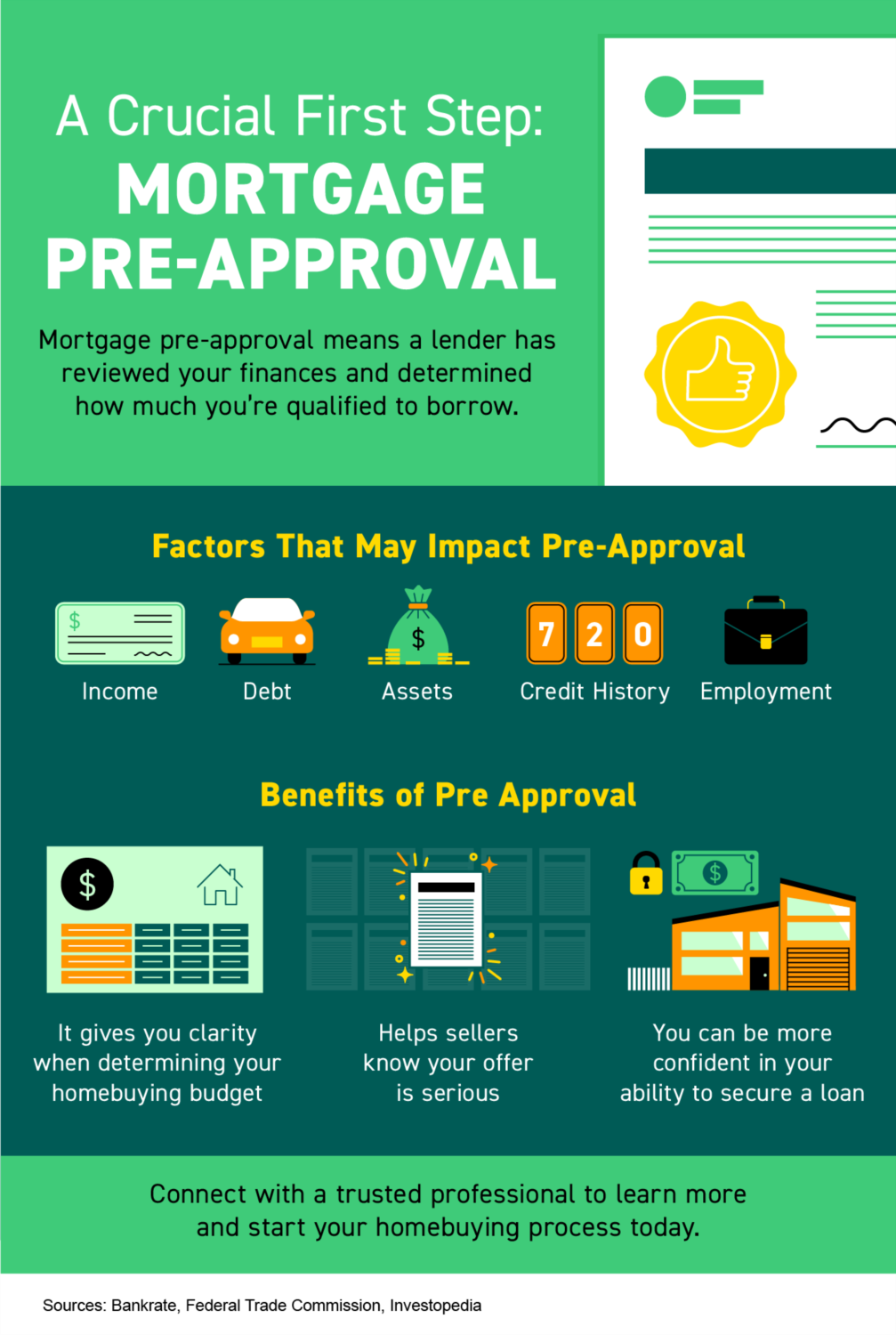

Your local Mortgage Professionals agent will meet along with you to discuss their financial need, bring a credit card applicatoin, opinion your borrowing from the bank bureau to you, test your money files, and you will calculate the debt ratios to choose how much mortgage your can qualify for.

After you have come pre-certified by your Mortgage Managers representative, you are prepared commit family shopping. Otherwise, while you are refinancing, your own representative will be able to fill out the job.

Adequate Work? Lenders want to see at the least six months a career to the same company. You really must be previous your probationary Period.

Insufficient Employment? When your tasks are seasonal or if you was has just thinking-functioning, our alternative loan providers could probably give you a hand.

Sufficient Earnings? Can be your income consistant? We are able to use income out of regular efforts, retirement benefits, long-term disability, child support, alimony, youngster taxation credit, and you can part-date money & self-a job money that appears on line 150 of the Money Canada Observe Off Examination if you’ve been in that role to possess about 24 months.

Loan Approval Processes

Try to give their large financial company which have duplicates regarding all earnings paperwork into our Documents Record found in our Library.

Decreased Earnings? If you fail to show your income as a consequence of paystubs, a job characters, and/or tax yields, the option loan providers have unique applications in which might use an excellent sort of resources of income to show you’re in business and generally are generating an income.

Enough Borrowing? Are you experiencing at the least 2 items of borrowing from the bank well worth from the the very least $2,five-hundred? Provides it started unlock for at least 1 year? Enjoys they all been paid off promptly? Are your balance less than their borrowing from the bank constraints?

The Mortgage Takes care of broker usually feedback your credit history and also make sure the information revealing on your agency are accurate. It is common for details about credit bureaus to-be aside of time, destroyed, otherwise revealing balances to the accounts which were paid back.

Lack of Borrowing? When you have had credit trouble like latest later payments, selections, decisions, bankruptcy proceeding otherwise user proposal, the alternative loan providers could probably help you get right back on your own legs contained in this a few years.

In case your house is during the property foreclosure, i have Individual Lenders that may be in a position to help you save your home.

Adequate Security otherwise Downpayment? If you are Buying a house, their off payments may come out of your offers, RSPs, income of the newest household, or a present out-of an immediate cherished one. You may need no less than 5% off + throughout the 3% to fund all closing costs. Unless you have enough money to fund every one of this, inquire about our $0 Advance payment system!

Diminished Guarantee otherwise Deposit? When you are alternative loan providers usually overlook a job, earnings, and you will borrowing facts, he’s very conservative toward amount of cash that they usually provide into a property. The will usually merely provide around 85% into a buy and just to 80% to the a refinance, based on your unique situation.

Personal Lenders usually financing almost somebody if they are only capital around about 70% of your own worth of your residence

Sufficient Assets? Whenever you are purchasing a house, standard house, mobile/micro domestic, otherwise a flat in the an effective normal home-based city having cuatro otherwise shorter systems, just be fine until our home a knockout post has actually structural products. You will find different laws and regulations to own cellular home into hired residential property. In the event the home is as well rural, keeps high acreage, or if it doesn’t enjoys season-bullet accessibility, some think it’s tough to program financing. The the loan providers is able to help you out with your uncommon features.