- Ca

- Colorado

- Washington

- Wisconsin

- Louisiana

- Arizona

- Las vegas, nevada

- The fresh new Mexico

- Idaho

In the event that these types of legislation apply to your, you will need acceptance from the judge to buy your the newest domestic. I encourage your mention neighborhood assets rules having a separation and divorce attorneys.

You also need to keep in mind that your partner’s loans will continue to be a, if you find yourself nonetheless partnered. The expenses https://clickcashadvance.com/installment-loans-me/ increases your debt-to-earnings proportion, cutting your probability of taking a home loan and you can so it is more unlikely your loan get an aggressive interest rate in the event that acknowledged.

Quitclaim and you can Interspousal Import

If you find yourself hitched in a condition having marital property and you can we would like to get a property, an effective quitclaim action or interspousal transfer action will need to be signed. When you’re to your a words, this isn’t always problems. not, should your companion really wants to end up being persistent you might find their brand new home try partly owned by your ex.

This new legal could potentially find that 1 / 2 of your new domestic try belonging to their broke up mate. If you cannot rating good concession from the mate so you’re able to indication a beneficial quitclaim action transferring new assets, you’ll end up best off waiting prior to purchasing.

Breaking up Your bank account

If or not you really have mutual levels or not, you should independent your money when you can before you could think to acquire a property.

When you submit an application for home financing, the lending company will at your costs. you might n’t have any really serious an excellent debts, even the same cannot be told you for the mate. However, if he’s got that loan, you may still get on the borrowed funds arrangement and you can responsible for it. When you could possibly get have not generated any payment on the they, the mortgage often affect your house loan application.

Throughout the separation and divorce, a separation arrangement are often used to document any an excellent costs and who they are assigned to. The new legal can also be designate financial obligation to just one of your own events during the this new divorce case and this will must be added to a separation agreement until the split up decree. This will prevent your ex’s costs from causing you trouble when your make an application for a different sort of mortgage until the situation are paid.

When you independent your bank account, your financial situation will become better and you can enjoys a beneficial better comprehension of the house financing you can afford adopting the separation and divorce try last.

If you reside into the a relationship possessions county, your earnings could be sensed neighborhood earnings. This makes it look like you really have less earnings to help you expend on property, reducing the mortgage offered by the financial institution. And making use of neighborhood earnings, while it is a, causes then troubles before separation and divorce try paid.

Temporary Commands

If the judge facts good directive you to constraints their entry to money inside split up, you may not manage to find the family you want. This type of short-term orders have to be accompanied otherwise you can also be positively hurt your splitting up.

If your former partner has accessible to signal an action enabling you to definitely purchase, and/or court has given permission, as well as your profit had been split up, you could begin so you’re able to plan your house purchase.

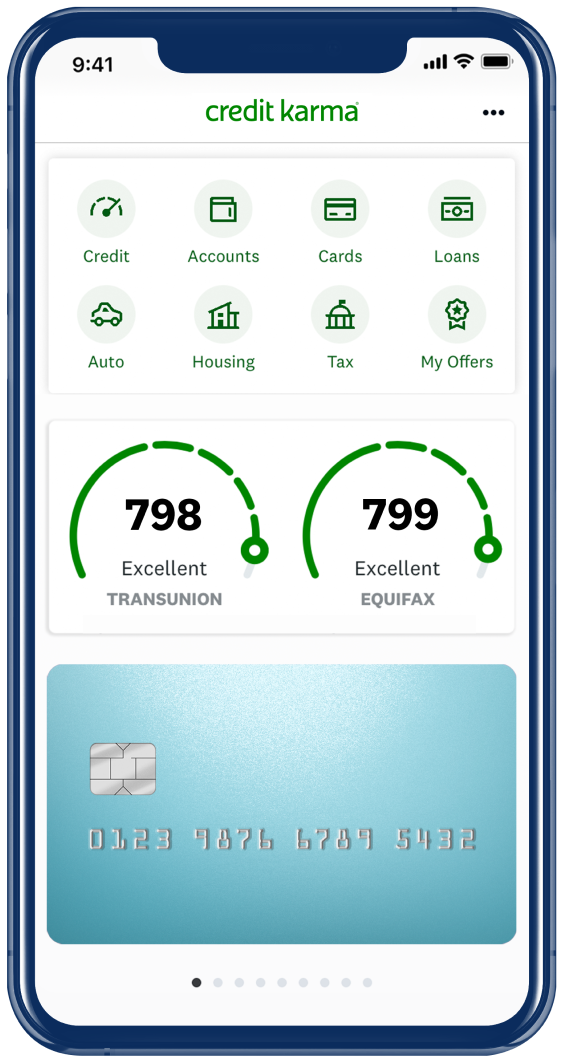

Make an effort to have the money getting a downpayment and also the most other will cost you with it when selecting a home. Your credit rating is additionally something that you need to imagine, which have better scores usually offering ideal terms and interest levels.

Deciding on the sort of home loan that’s effectively for you are an important action. Government-backed loans on FHA, Va, and USDA bring several benefits, such low otherwise zero off costs and more lenient loan degree standards. When you have a good credit score and a stable business, a traditional mortgage was a better solution.